Amex Blue Cash Everyday or Preferred. Which is Right For You?

UPDATE: The Annual Fee for the Blue Cash Preferred Card is increasing to $95 on 8/3/16. See my updated post here.

There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could be well worth paying.

Lets compare the two popular cash back credit cards offered by American Express–one that charges an annual fee and one that doesn’t–Blue Cash Everyday and Blue Cash Preferred. I’ll walk you through the extra benefits and do all the necessary math for you with a calculator at the end of this article.

Here are the basics:

Blue Cash Everyday

- 3% Cash Back at U.S. supermarkets, up to $6,000 per year in purchases (then 1%)

- 2% cash back at U.S. gas stations

- 2% Cash Back at select U.S. department stores

- 1% Cash Back on other purchases.

- No Annual Fee

- $100 sign-up bonus after $1000 spend in first 3 months

Blue Cash Preferred

- 6% Cash Back at U.S. supermarkets up to $6,000 per year in purchases (then 1%)

- 3% Cash Back at U.S. gas stations

- 3% Cash Back at select U.S. department stores

- 1% Cash Back on other purchases

- $75 Annual Fee

- $150 sign-up bonus after $1000 spend in first 3 months

As you can see, increased benefits come with the annual fee, but is it worth it for you? According to this report by the Bureau of Labor Statistics, in 2014 the average US household spent:

- $3,971 for food at home

- $2,468 on gasoline and motor oil

- $1,786 on apparel and services

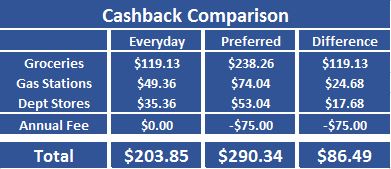

Using those average spending statistics and the individual benefits of each card, we can compute how much cashback would be earned in each of those spending categories during the first year of holding either card.

Factoring in the annual fee, the average US household would earn $86.49 in additional cash back by using the Blue Cash Preferred vs. the exact same spending on the Blue Cash Everyday. This doesn’t factor in the better signup bonus for the Preferred.

Calculator

Enter the values that you feel are most appropriate based on your personal spending habits. After you press the “Calculate” button, Cashback Comparison table will be updated. Then you’ll know which card is more appropriate for you.

| Cashback Comparison | |||

|---|---|---|---|

| Everyday | Preferred | Difference | |

| Groceries | |||

| Gas Stations | |||

| Dept Stores | |||

| Annual Fee | 0 | -75 | -75 |

| Totals | |||