-

10% Cash back at Restaurants with Amex Blue Cash

American Express has announced a unique promotion for new customers applying for their Blue Cash Everyday and Blue Cash Preferred Cards. New Card Members will earn 10% cash back at restaurants in the first six months, up to $200. New Card Members will also receive the regular welcome bonus of $100 for the Everyday or $150 for the Preferred. These cashback bonuses come in the form of a statement credit after spending $1000 in the first 3 months after approval. If you are a targeted customer (or if you use your browser’s “incognito” window), the welcome bonus may be as high as $250 for either card. To decide which card is…

-

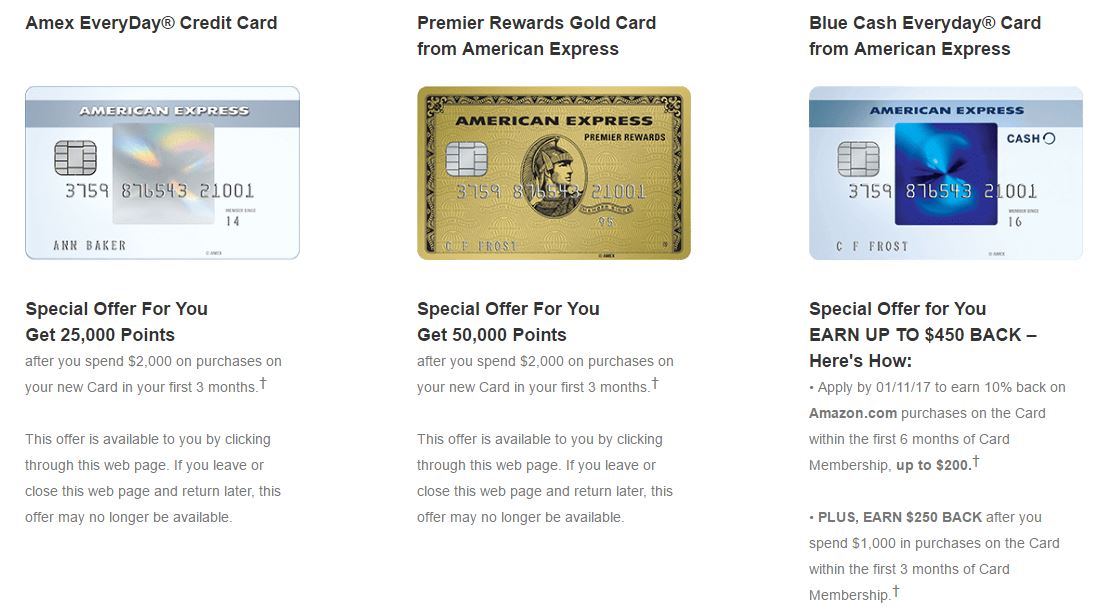

Higher Signup Bonus Offers for Amex Credit Cards

If you’re looking to apply for a credit card from American Express, see if you can find a better offer online. This method has been spotty lately, but in the last few hours, it seems many higher offers have become readily available. Simply open an incognito or private browsing window in your favorite browser, navigate to the americanexpress.com website (don’t log in), and click on “Personal Cards.” If you only see standard offers, close the window and try again. Usually within 2 or 3 tries, I see the better offers. These are only some of the offers I was able to see before writing this post: Give it a shot…

-

Amex Blue Cash Signup Bonus: 10% off at Amazon

American Express has announced a unique promotion for new customers applying for their Blue Cash Everyday and Blue Cash Preferred Cards. The entire signup bonus could potentially be worth $450, depending on the offer you receive. The regular signup bonus is $100 for the Everyday and $150 for the Preferred. These cashback bonuses come in the form of a statement credit after spending $1000 in the first 3 months after approval. If you are a targeted customer (or if you use your browser’s “incognito” window), this offer may be as high as $250 for either card. In addition to the regular cashback incentive, the promotional bonus offers 10% credit on up…

-

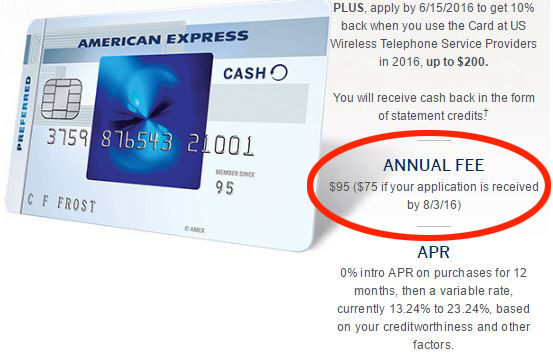

Amex Blue Cash Preferred Raising Annual Fee

Beginning August 3, 2016, the Annual Fee for the American Express Blue Cash Preferred credit card is increasing from $75 to $95. There’s been no announcement other than the notation on the web-based application. There is also no indication of any enhancement to the card’s benefits. The rest of this post is an update of Amex Blue Cash Everyday of Preferred. Which is Right For You? There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could…

-

Amex Blue Cash Everyday or Preferred. Which is Right For You?

UPDATE: The Annual Fee for the Blue Cash Preferred Card is increasing to $95 on 8/3/16. See my updated post here. There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could be well worth paying. Lets compare the two popular cash back credit cards offered by American Express–one that charges an annual fee and one that doesn’t–Blue Cash Everyday and Blue Cash Preferred. I’ll walk you through the extra benefits and do all the necessary math…

-

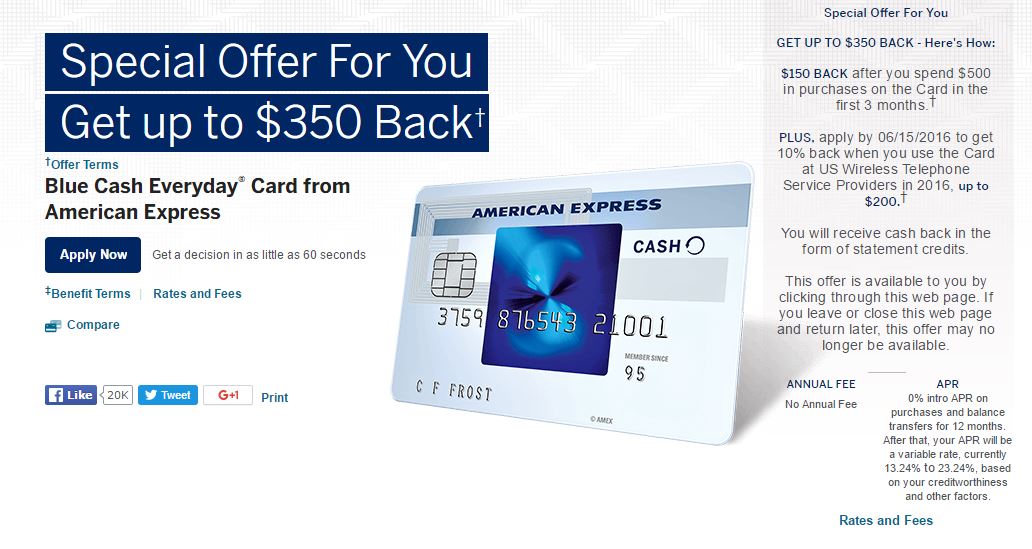

Unique Credit Card Signup Offer for Amex Blue Cash Everyday

American Express has announced a unique promotion for new customers applying for their Blue Cash Everyday Card. This offer could potentially be worth $350–not bad for a no annual fee card–but there are some caveats. The regular signup bonus for this card is $100 cashback in the form of a statement credit after spending $1000 in the first 3 months after approval. If you are a targeted customer (or if you use your browser’s “incognito” window), this offer may be as high as $150. In addition to the regular cashback incentive, the promotional bonus offers 10% credit on purchases at U.S. Wireless Telephone Service Providers up to $200 through the end…

-

Get a Credit Card Signup Bonus with your Next Big Purchase

Do you have a fairly large purchase requirement on the horizon? Consider applying for a new credit card that offers a generous signup bonus on which you can charge the purchase to soften the blow. If you have excellent credit and don’t plan on shopping for any loans in the next few months, then this might be exactly the right time! The most lucrative benefit a credit card typically offers is its signup bonus. For many consumers, however, the biggest hurdle to earning the bonus is meeting the minimum spend requirement. But if you’re about to buy some new furniture, jewelry or appliance, or you just NEED to have that 70″ flat screen 4k Ultra HD…

-

Best Credit Cards for Balance Transfers

Did you run up large credit card balances during the holidays this year? If you won’t have enough cash to pay them off in full, those interest charges are going to start adding up quickly. One way to save money is by transferring your balances to a credit card that has a lower interest rate (APR). Chase Freedom, Citi Double Cash, and American Express Blue Cash Everyday are popular credit cards that offer an introductory 0% APR for 15 months on balance transfers. Unfortunately, they all charge a 3% transfer fee. If you’re looking to consolidate $2,500 to one of these cards, the fee will cost you $75. Chase Slate is a…

-

Credit Card Annual Fees: Are They Worth It?

There are those who would never apply for a credit card that charges an annual fee. Why pay when there are so many other cards that don’t charge one? A valid question, and the answer depends on your spending and lifestyle habits. As you’ll see below, in some cases, those fees could be well worth paying. Annual fees can top out at over $400 for some premium credit cards, but they can include access to airport lounges such as American Airlines, Delta, or United. These private lounges offer travelers free food, snacks, complimentary beverage service, comfortable seating, free WiFi, clean facilities, and other luxurious perks not available to the general public. If you fly frequently…

RECENT POSTS