-

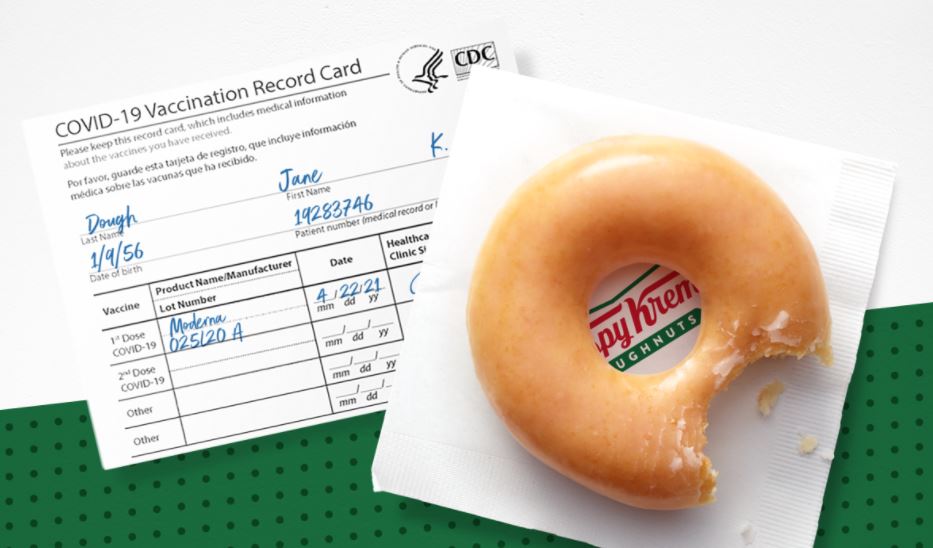

Don’t Lose Your CDC Vaccination Card

Yesterday, I received my second Pfizer COVID-19 vaccination. This is will allow me to be comfortable doing more things and going more places than I have since the start of the pandemic. After I got my second shot, I started to realize just how important the CDC Vaccination Card can be. It can be somewhat of a passport for travel, entertainment and dining. Travel: In the past few days, Royal Caribbean and Celebrity Cruise Lines announced a return to sailing for vaccinated passengers. In addition, Iceland has opened its borders to vaccinated travelers. For both, you can use your CDC Card as proof of vaccination. Entertainment: Just yesterday, Madison Square…

-

I Saved 40% on my Rental Car… So Far

See my final update near the end of this post. Autoslash continued to look for lower rates right up to my trip. I have an upcoming long weekend trip to Toronto where I’ll need to rent a car. Since I’m a points/miles/travel blogger I don’t need any help finding the best price, right? Wrong! For this rental, I decided to try Autoslash for the first time. I’ve heard plenty of recommendations in the past, but for some reason, I’d never tried them. I’ve always felt I could just do better on my own. Well, allow me to eat some crow. What is Autoslash? Autoslash likens itself to a team of obsessive grocery store coupon-clippers. You know the…

-

Fresh Look for the Site

After a couple years with the same look for the site, I thought it was time for a change. This morning, I updated the website with a fresh new style. Major new features include a search button on the main menu, Featured Posts on the home page, and plenty of Related Posts sections to help with your navigation. I hope you all like the changes! If you like the information in this article, please consider supporting this blog by shopping with my Amazon Referral link.

-

RIP Sallie Mae Rewards Credit Card

According a post by user davidknowsbest on Reddit, the Sallie Mae Rewards credit card will be discontinued soon. On March 1, 2017, the card will convert to Commence Mastercard. The Sallie Mae Rewards card had not been available to new applicants for about a year. Prior to that, it was originally marketed with students in mind, but quickly became a favorite for anyone looking for high cash back rewards. The card offered 5% cash back on Amazon.com, books, gas, and grocery purchases, and 1% cash back on all other purchases. Legacy cardholders continued to enjoy the benefits of the card at no annual fee. On March 1, 2017, that will change. According to…

-

Ebates Cyber Monday – Double Cashback at 600+ Stores

Ebates, the popular cash back shopping portal, is running a Cyber Monday 600 special today only. Get double cashback at over 600 stores when you click through their portal. If you’re not familiar with shopping portals, you can read my full primer here. In short, shopping portals are websites that provide links to various retailers’ websites. In return for directing customers to their site, those retailers pay a commission to the portal for each customer that makes a qualifying purchase. The portal then allots a portion of that commission–in the form of points or cash–to the original customer. For example, today only you can get 12% cashback at Macy’s and 10% at Bloomingdales. Check your…

-

AAA Member Rewards Visa – Solid Cashback Credit Card for Travelers

Are all these points and miles travel credit cards too complicated for you? The AAA Member Rewards Visa Signature card is a great credit card for travelers who are just looking for simple cashback. If you are a Bank of America Preferred Rewards client, the benefits get even better. Don’t let the name fool you–it’s not necessary to be an AAA member to apply for this card. It’s available for anyone with suitable credit. With no annual fee and bonus cashback categories like travel, gas stations, grocery stores, and drugstores, I’m surprised this card isn’t more popular. AAA Member Rewards Card Details No Annual Fee No Foreign Transaction Fee 3% cash…

-

Should I Cancel a Credit Card I No Longer Use?

There are times when it makes sense to cancel a credit card, but it’s oftentimes better not to. In “Before You Cancel That Credit Card, Read This!“, I wrote about the effects that canceling a card have on your credit score–it can never help, only hurt your score. In this article, I’ll go through some of the more common reasons I see given for wanting to cancel a card and discuss the validity of each reason. I have too much available credit This is a common misconception in consumer finance. Banks actually prefer if you have a large and varied amount of available credit. Risk is reduced by spreading it out…

-

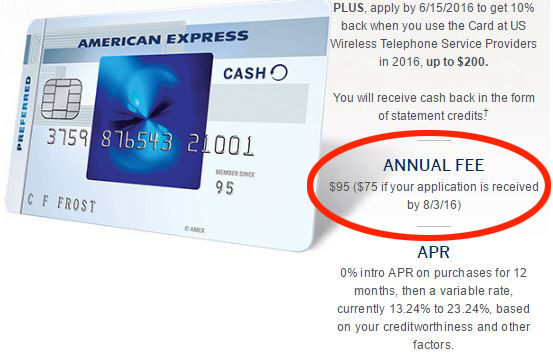

Amex Blue Cash Preferred Raising Annual Fee

Beginning August 3, 2016, the Annual Fee for the American Express Blue Cash Preferred credit card is increasing from $75 to $95. There’s been no announcement other than the notation on the web-based application. There is also no indication of any enhancement to the card’s benefits. The rest of this post is an update of Amex Blue Cash Everyday of Preferred. Which is Right For You? There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could…

-

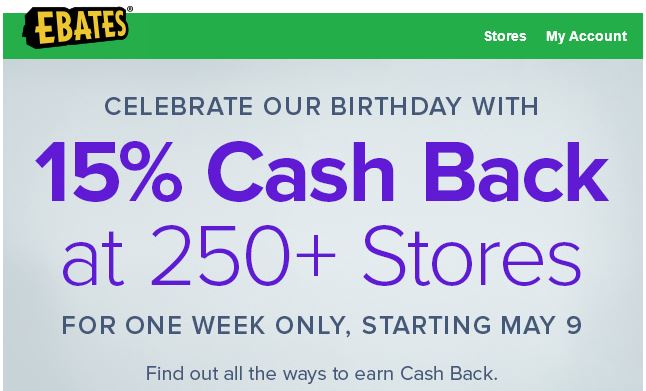

Celebrate Ebates’ Birthday With 15% Cash Back

To celebrate its birthday, Ebates is having a 15% Cash Back Party, featuring over 250 stores. The celebration begins on May 9 and will last one week. Doing your online shopping through a portal is a great way to earn extra cashback in addition to rewards earned with your credit card. I’ve always found the popular Ebates to be very competitive and reliable. What is a shopping portal? In short, a shopping portal is a website that provide links to various internet retailers. In return for directing customers to their site, those retailers pay a commission to the portal for each customer that makes a qualifying purchase. The portal then allots a portion of…

-

Amex Blue Cash Everyday or Preferred. Which is Right For You?

UPDATE: The Annual Fee for the Blue Cash Preferred Card is increasing to $95 on 8/3/16. See my updated post here. There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could be well worth paying. Lets compare the two popular cash back credit cards offered by American Express–one that charges an annual fee and one that doesn’t–Blue Cash Everyday and Blue Cash Preferred. I’ll walk you through the extra benefits and do all the necessary math…

RECENT POSTS