-

Higher Signup Bonus Offers for Chase Sapphire Cards

For a limited time, Chase has increased the signup bonus offers on its Sapphire Preferred (80,000 Ultimate Rewards points) and Sapphire Reserve (60,000 UR points) cards. Both offers require a minimum spend of $4,000 in the first 3 months of holding the card. For those who live in or near bank Chase’s branch footprint, the Sapphire Preferred in-branch offer also includes no-annual-fee for the first year ($95 otherwise). To be approved for either card, you must satisfy ALL of the following: You must not currently hold any other Sapphire branded card AND You must not have received a signup bonus for any Sapphire card in the last 48 months You…

-

Chase Annual Fee Refunds

Have you just gotten hit with your Chase premium credit card’s annual fee? Now is a good time to review the card’s benefits to see if it’s still worth holding. If you no longer want the card, you have 2 options: cancel the card or product change to a no-annual-fee card. Here’s how to make sure you get that annual fee refunded. Canceling Your Chase Card The Chase annual fee refund policy is consistent across it’s entire card catalog. If you look closely at your printed statement, you’ll find the policy in the Annual Renewal Notice section: The annual membership fee is non-refundable unless you notify us that you wish…

-

Chase Adds $50 Grocery Credit for New Sapphire Preferred Signups

Chase has added an additional bonus for new Sapphire Preferred signups–$50 in statement credits towards grocery store purchases in the first year. This sweetener comes in addition to the standard 60,000 Ultimate Rewards Point bonus after spending $4,000 in the first 3 months. The usual application restrictions are in order. You must not currently have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months. This includes the Sapphire Reserve card. In addition, you must be under 5/24. If you don’t know what that means, you can read my Chase 5/24 Rule Primer and my 9 Things to Know About…

-

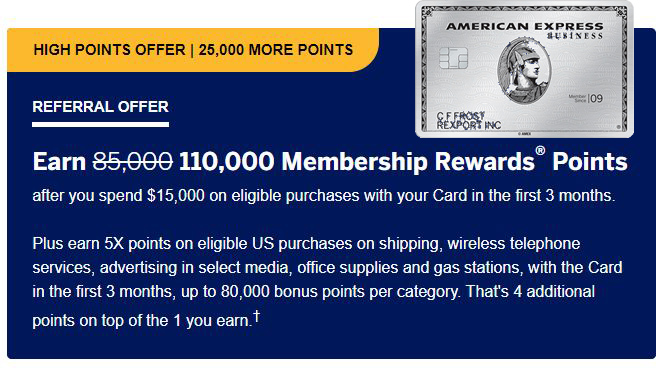

Amex Biz Platinum 110k Signup Bonus Offer via Referral

I’m seeing some 110,000 Membership Rewards points signup bonus offers for the Business Platinum Card from American Express this morning. The welcome bonus is usually 85,000 MR points. You can earn this bonus after spending $15,000 on eligible purchases with the card in the first 3 months. The welcome offer is not available to applicants who have or have had this card in the past. So if you’ve never had the Amex Business Platinum before, now would be a great time to apply. Getting the 110k Point Offer Getting this offer requires some effort. You need to use someone’s referral link (feel free to try mine if you don’t have…

-

Amex Platinum Adds New $30 Monthly Paypal Credit

American Express Platinum Cardmembers can now receive up to $30 per month in PayPal credits through June, 2021. That adds up to $180 in new value from the $550 premium travel card. The credits are automatic, there’s no need to register or activate your card. During the pandemic with customers reduced travel, banks have been adding temporary benefits to their premium credit cards. The Platinum Card from American Express continues that trend. All you need to do is add your Amex Platinum card as a payment method to your PayPal account. Then shop at a merchant that accepts PayPal and check out by clicking the PayPal button. Make sure the…

-

When to Re-Apply for Chase Sapphire Reserve

Are you looking to re-apply for the Chase Sapphire Reserve card? Is it getting very close to 48 months since you got your last Sapphire welcome bonus? It may be closer than you think. The Chase Sapphire Reserve card was originally introduced over 4 years ago. At 50,000 points, the signup bonus is only half of what it was in its early days, but the card is still very popular despite the $550/yr annual fee. Those that were approved the card in its first months could be looking to apply again when eligible for another welcome bonus. But when is that exactly? First, lets look at the eligibility rule before…

-

Chase Freedom Flex Q1 2021 Bonus Categories

The Chase Freedom and Freedom Flex credit cards earn 5% cash back in bonus categories that change each quarter. The categories for the 1st quarter of 2021 have just been announced. Earn 5% cash back on up to $1,500 in combined purchases from January 1 – March 31, 2021 in the following categories: Wholesale Clubs including BJs, Costco, Sam’s Club, and Texas Jasmine. Gas, fuel, wholesale specialty service purchases such as travel, insurance, cell phone and home improvement are excluded. Internet, Cable, and phone services Select streaming services, including Disney+, Hulu, ESPN+, Netflix, Sling, Vudu, Fubo TV, Apple Music, SiriusXM, Pandora, Spotify, YouTube TV As a reminder, with Freedom and Freedom Flex, you need to…

-

9 Things to know about the Chase 5/24 rule

I had a recent exchange with someone claiming to have been approved for the Chase Freedom Unlimited despite being at 5/24. As it turns out, he was only 4/24, and that’s why he wasn’t declined. How could it be so hard to count to 5? Well, Chase’s 5/24 rule is not so straightforward. In fact, it’s downright confusing. It can make a reasonably intelligent person have trouble counting to 5. In this post, I will explain 9 of the most confusing concepts of the 5/24 rule, including the reason that the Freedom Unlimited application I mentioned above was approved. What is the Chase 5/24 Rule? If you want a full…

-

Primer on Chase Sapphire Reserve $300 Travel Credit

Update: Due to the lack of travel during the COVID-19 pandemic, Chase has extended the ability to apply the travel credit to purchases at grocery stores and gas stations through June 30, 2021. The annual $300 Travel Credit is easily the most lucrative benefit of the Chase Sapphire Reserve card. Questions about what it covers and when it resets have been plentiful. It’s important to understand the benefit to know if and/or when you should apply. Fully monetizing the credit each year will effectively reduce the annual fee of the Sapphire Reserve from $550 to a net $250. You can receive this benefit twice in the first year of holding…

-

Booking Cruises with Chase Ultimate Rewards Points

Chase Ultimate Rewards points are a versatile currency. Much has been written about transferring them to travel partners and redeeming them for flights and hotels. Another great choice is to redeem them for a cruise. I freely admit that cruises aren’t for everyone. If you’re still reading, I suspect you might enjoy them. For those that do, it’s a great way to redeem a stash of Ultimate Rewards points. Since cruise fares include meals and entertainment, and many packages include drinks, gratuities and credit to use on board, you’re effectively using points to pay for your entire all-inclusive vacation. The Value of Ultimate Rewards Points There are currently 7 available…

RECENT POSTS