The Chase 5/24 Rule: When a Great Credit Score Isn’t Enough

You earn a good salary and your credit score is over 750, but Chase just denied your credit card application. How can this be? If you’ve opened 5 or more credit cards from any bank in the last 2 years, you just became the latest victim of the Chase 5/24 rule.

Your good credit history is usually the most important prerequisite banks look for in order to approve you for a credit card. But with Chase’s unique credit card approval rule, your stellar credit takes a back seat to your potential profitability. Before applying for any Chase credit card, you’ll need to know what the Chase 5/24 rule is and if it applies to you.

Here is how I define the Chase 5/24 “rule” in its simplest terms: if your credit report lists 5 or more credit card accounts from any bank opened in the last 24 months, Chase will–in almost all circumstances–initially deny your application for many of their credit cards, regardless of any other factors.

I refer to this as a “rule” in quotes for a few reasons:

- this “rule” is not documented anywhere publicly, it just seems to be part of Chase’s approval/denial algorithm

- it has only been defined by researching months of empirical approval/denial data points in online forums such as Flyertalk and Reddit

- Chase’s computer algorithm counts cards that a live agent might not

- it’s not clear that the rule always applies to all cards

Background

The credit card business is a competitive and crowded marketplace. In an effort to constantly attract new and profitable customers, card issuers offer generous sign-up incentives. However, not all customers are profitable. After earning the sign-up bonus, some cancel that credit card and move onto the next lucrative sign-up offer, repeating that process over and over.

In an effort to minimize this “churning” behavior while continuing to offer incentives to new customers, banks have added more restrictive offer terms over the last couple years. American Express will only allow you to receive a card’s bonus once per lifetime. Here’s the verbiage from one of their credit card terms:

Welcome bonus offer not available to applicants who have or have had this product.

Citi has changed their offer terms 3 times in the last 2 years–each one more restrictive than the last. With the latest change, you can’t receive a sign-up bonus if you’ve opened or closed the same or similar points/miles earning cards in the last 24 months. Here’s the key language from the Citi Prestige terms:

Bonus ThankYou points are not available if you have had ThankYou Preferred, ThankYou Premier or Citi Prestige cards opened or closed in the past 24 months.

Chase’s terms add a different wrinkle. For most cards, they don’t just limit bonus eligibility like American Express and Citi, they limit your eligibility for the “product” itself. From the Freedom Unlimited offer terms:

This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.

In addition to this restriction, Chase has added one additional layer with its 5/24 rule. It appears that their analysis tells them that an applicant with 4 or fewer recent accounts is more likely to be a profitable customer. An applicant with 5 or more recent accounts is someone they’d just rather not do business with.

What You Need to Know About Chase 5/24

Before applying for any Chase credit card, you need to go through a checklist so you don’t waste a credit inquiry. If you have a strong likelihood for a denial, it’s best not to bother applying.

Is the card I am applying to subject to the rule?

UPDATE: Chase appears to recently have expanded the 5/24 rule to it’s entire catalog of credit cards. Rather than strike through the list of cards that were and weren’t affected, I have removed the entire section for the sake of clarity.

How Many New Accounts Did I Open in the Last 24 Months?

You don’t remember what credit cards you opened 2 years ago? You’re not alone. Luckily, it’s easy to check the same way Chase clearly does–by counting the accounts on your credit report. I’ll use CreditKarma to demonstrate how.

Log in to your CreditKarma account. On the Dashboard choose “Accounts”. You can then choose to “Go to Transunion credit report” or “Go to Equifax credit report”. The information you need should be identical on both reports, so you can choose either.

CreditKarma used to allow you to sort your accounts in reverse chronological order to make it easier to count the most recent. Unfortunately, now you have to expand each account and check the Open Date. If it was less than 24 months ago, it counts.

When you get to the bottom of the list, you’ll notice a link called “Show Closed”. You need to check there too–even closed accounts count if they were opened less than 24 months ago.

Finally, add up your total. If you have 4 or fewer accounts opened in the last 24 months, you won’t be denied by Chase due to 5/24. If there’s 5 or more, you’ll need to do a little more work.

Which Accounts Count and Which Don’t?

The “Accounts” section on your credit report also lists mortgages, car loans and leases, student loans, etc. Because Chase’s 5/24 rule has been defined solely by way of data points, it’s difficult to determine if these other accounts factor into the rule. Most data points indicate that only credit card accounts are included.

Chase’s automated credit algorithm may initially count store credit cards like Target, The Gap, and Kohl’s and deny your application due to 5/24. A call to Chase’s reconsideration line with a live agent will get those cards ignored.

Your credit report doesn’t only list your primary credit card accounts. Anyone else’s accounts to which you’ve been added as an authorized user are also listed. Many data points suggest that authorized user accounts do initially count against your 5 in the last 24 months. For example, if you have 3 new credit cards and your spouse added you as an authorized user on 2 of his or her new credit cards, you’ll see 5 accounts on your report and Chase will count all 5–meaning you’re at their limit.

Once again, a call to the reconsideration line will get Chase to ignore the authorized user accounts after having initially denied you. Simply ask the agent to list each credit card that you’ve opened in the last 24 months. For each authorized user card, tell the agent, “I am not financially responsible for that account.” Those are the magic words.

If you run a small business, you may have business credit cards which are not listed on your credit report. This is normal and works in your favor as Chase can’t count what they can’t see.

The same applies for non-Chase credit cards that you just opened which may not YET appear on your credit report. For instance, some American Express credit cards take two billing cycles to appear on your report. If you act fast, you can get around the 5/24 rule before Chase can count them.

Variables

There’s still a lot we don’t know about this rule. Because it does not appear in any terms and has been cobbled together using data points, it’s difficult to pinpoint exactly where the lines are drawn. Does 5/24 mean exactly 24 months to the day? Or to the month? Will all the other Chase offerings be subject to this rule at some point? Are certain customers not subject to the rule at all? Is it better to apply in-branch? Do retail store credit card count as well? Answers to these questions have varied.

Sapphire Reserve Applications Provide Some Answers

Data points from applications for the recent introduction of the Sapphire Reserve card have answered a few key questions about the Chase 5/24 rule. Here’s what we’ve learned recently:

- In branch pre-approvals DO circumvent 5/24 but only if you apply in-branch

- Online offers with green check marks also appear to circumvent 5/24

- Online pre-approvals are NOT an indication that you are pre-approved in-branch

Chase Private Clients are not subject to 5/24Chase Private Clients are no longer exempt.

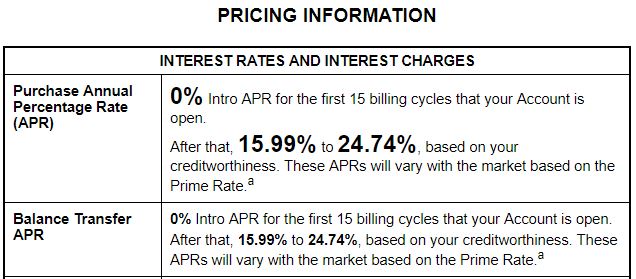

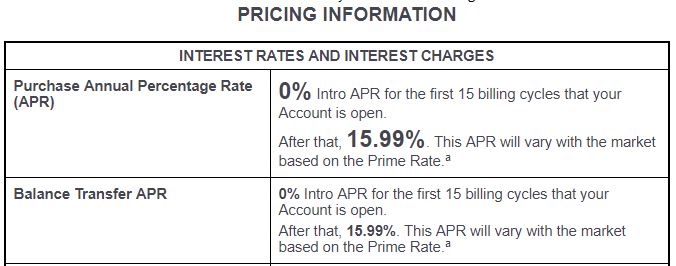

Pre-approvals can be identified by looking at the Interest Rates and Interest Charges section of the Schumer Box. If the Purchase APR is a range, like 15.99% – 24.74%, this is not a pre-approved offering.

If the Purchase APR is fixed, like simply 15.99%, then this is a pre-approved offering and should circumvent the 5/24 rule.

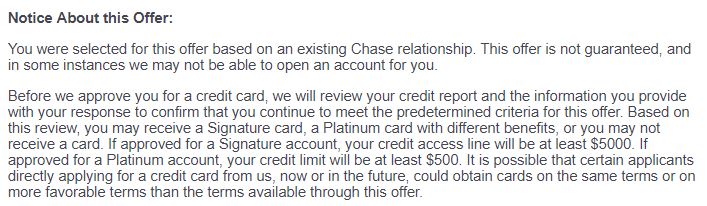

Another sure sign of a pre-approved offer is language in the terms about you being selected for the offer based on your relationship with Chase.

To find out if you’re pre-approved for a particular Chase credit card, visit a Chase branch and speak to a banker. Tell him/her that you’re interested in applying for a credit card and that you’d like to know what cards you’re pre-approved for first. So far, there’s no clear method on how to trigger these magical pre-approvals.

You can take matters into your own hands by becoming a Chase Private Client. Unfortunately, the requirement is that you have a combined $250,000 in assets at Chase. There have been reports of bankers granting CPC status to customers with a lower amount, but we’re still talking about six-figures. This status will allow you to circumvent the 5/24 rule.

Bottom Line

If you intend to apply for any (or multiple) Chase credit cards in the future, you need to plan accordingly. Understand the Chase 5/24 rule and see where you are currently. Begin by applying for the cards that are subject to the rule first, BEFORE you reach the the limit of 5. Then move on to other cards that are no subject to the restriction.

Have you been affected by the Chase 5/24 rule?