-

Citi Hilton Cards Moving to Amex in January

Back in June, Hilton announced that American Express would become the exclusive issuer for Hilton Honors co-branded credit cards in the United States beginning January 1, 2018. As that date is approaching, the question of what would become of current Citi Hilton Card holders as finally been addressed. American Express has revamped its portfolio of Hilton Honors credit cards. They’ve added two new cards and increased benefits to re-branded versions of their 2 existing cards. Current Citi Hilton cards will be automatically replaced with one of those two re-branded cards on January 30, 2018. The Citi Hilton Honors Card will automatically be replaced with a Hilton Honors American Express Card. If you have…

-

Make Sense of Your Free Credit Scores

Is your shirt size medium or large? How about your dress size? Or your shoe size? Very often, your size depends on what store you’re shopping in. Believe it or not, the same goes for your credit scores. They’re different depending on where you get them from. I’ll show you how to make sense of your free credit scores, how they’re calculated, and which ones are more meaningful than others. What is a Credit Score? Your credit score is a 3 digit number that represents your creditworthiness to lenders. The higher the number, the more creditworthy you are. This score is derived from all of the data that’s in your…

-

Limited Time Offer – Citi Hilton 75k Honors Bonus Points

For a limited time, you can earn 75,000 Hilton Honors bonus points when you apply for the Citi Hilton Honors Visa card. The normal bonus for this card is only 40,000 points, making this an excellent time to sign up! Citi Hilton Honors Visa Signature Card Regular Bonus: 40,000 Honors Points after spending $1,000 in the first 4 months. Limited Time Offer: 75,000 Honors Points after spending $2,000 in the first 3 months. Earn 6 Honors Bonus points per $1 spent on hotel stays within the Hilton Portfolio. Earn 3 Honors points per $1 spent at supermarkets, drugstores & gas stations. Earn 2 Honors points per $1 spent on all…

-

Limited Time 50k Signup Bonus for BarclayCard Arrival+

For a limited time, you can get a 25% higher signup bonus for the BarclayCard Arrival Plus World Elite MasterCard. Instead of 40,000 “miles”, new cardholders who meet the spending requirement will receive 50,000 “miles”. As I wrote in my full review of the BarclayCard Arrival Plus, the word “miles” is only a marketing gimmick. The “miles” are really just points that you can redeem for statement credits against certain travel expenses. Effectively, it’s a cashback credit card with limitations on how you can redeem your points. Card Details Earn 40,000 50,000 bonus miles after you spend $3,000 on purchases in the first 90 days Earn 2X miles on all purchases Get 5% miles back after each redemption…

-

Amex Announces New Platinum Card Benefits

After recent buzz about potential new benefits coming to the Platinum Card, today American Express announced the changes. Beginning October 6, consumers with a Platinum Card from American Express will receive 5X Membership Rewards points on airfare booked directly with airlines or through American Express Travel. Also, Business Platinum Card Members will now earn 50% points back (up from 30%) when using Membership Rewards Pay with Points through American Express Travel to book an economy flight with their selected airline or a first or business class ticket with any airline. In addition, Business Platinum Card Members can earn 1.5X Membership Rewards points per dollar spent on any individual purchase of $5,000 or more. “Our new…

-

New Citi Prestige Applicants Losing AA Lounge Benefit Soon

Last month, news broke that Citi Prestige cardholders would be losing access to American Airlines Admirals Clubs. A few days later, Citi confirmed that, and many other negative changes to the card. The only good news was that Citi was giving one year notice of the changes, which are due to take effect July 23, 2017. However, there is one change that will affect new applicants much sooner. According to various reports, new Citi Prestige applicants must be approved by August 31, 2016 to have Admirals Club access through July 23, 2017. If you become a cardholder on September 1 or later, you will not have the AA lounge club benefit…

-

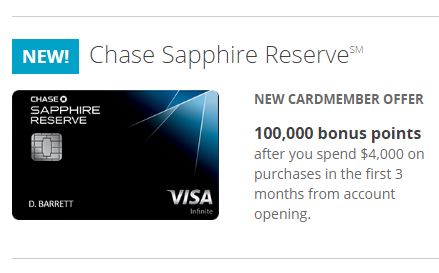

The New Chase Sapphire Reserve Card Looks Fantastic!

UPDATE: The 100,000 point signup bonus offer for online applications will be reduced to 50,000 on January 12, 2017. Chase has introduced its new premium travel credit card, Sapphire Reserve, and it looks fantastic! Loaded with benefits, it carries a hefty $450 annual fee. This new addition to its lineup finally gives Chase a direct competitor to The Platinum Card from American Express and Citi Prestige. Sapphire Reserve offers a myriad of travel benefits that more than make up for the annual fee, including an annual $300 travel credit, complimentary Priority Pass airport lounge access, and Global Entry/TSA Pre✓ credit. Unfortunately, this card is subject to Chase’s restrictive 5/24 rule. Last week, I wrote…

-

New Chase Sapphire Reserve: Now You See It, Now You Don’t

Update: Chase has clarified that the Visa Infinite $100 credit towards 2-5 domestic flights will not be included as a benefit of the Chase Sapphire Reserve. I’ve updated this post accordingly. Yesterday afternoon, Chase prematurely accepted online applications for it’s new, but yet-to-be-announced flagship credit card, Chase Sapphire Reserve. The link to the application page was discovered and posted by a user on reddit. A short time later, another link listing the card’s benefits was posted by a different user. Within a couple hours, the party was over as Chase took down the links. During the time that the links were active, applications to Sapphire Reserve did not appear to be subject to the…

-

The Chase 5/24 Rule: When a Great Credit Score Isn’t Enough

You earn a good salary and your credit score is over 750, but Chase just denied your credit card application. How can this be? If you’ve opened 5 or more credit cards from any bank in the last 2 years, you just became the latest victim of the Chase 5/24 rule. Your good credit history is usually the most important prerequisite banks look for in order to approve you for a credit card. But with Chase’s unique credit card approval rule, your stellar credit takes a back seat to your potential profitability. Before applying for any Chase credit card, you’ll need to know what the Chase 5/24 rule is and if it applies to you. Here…

-

More Negative Changes to Citi Prestige Coming

In an earlier post, I wrote about Citi’s plans to discontinue complimentary American Airlines Admirals Club lounge access for Prestige cardmembers. Unfortunately, that was only the beginning. More Citi Prestige changes have been announced and they’re all bad. In addition to the loss of Admirals Club access, Citi is reducing the value of ThankYou points redeemed for flights, discontinuing the Complimentary Golf benefit, and reducing the value (in some cases substantially) of the 4th Night Free hotel benefit. All these changes are to take effect July 23, 2017. Citi Prestige Changes Access to American Airlines Admirals Club lounges will no longer be offered. After July 23, 2017, current cardmembers will…

RECENT POSTS