-

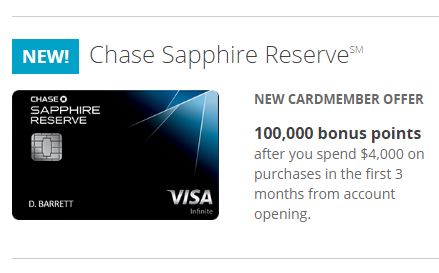

The New Chase Sapphire Reserve Card Looks Fantastic!

UPDATE: The 100,000 point signup bonus offer for online applications will be reduced to 50,000 on January 12, 2017. Chase has introduced its new premium travel credit card, Sapphire Reserve, and it looks fantastic! Loaded with benefits, it carries a hefty $450 annual fee. This new addition to its lineup finally gives Chase a direct competitor to The Platinum Card from American Express and Citi Prestige. Sapphire Reserve offers a myriad of travel benefits that more than make up for the annual fee, including an annual $300 travel credit, complimentary Priority Pass airport lounge access, and Global Entry/TSA Pre✓ credit. Unfortunately, this card is subject to Chase’s restrictive 5/24 rule. Last week, I wrote…

-

The Chase 5/24 Rule: When a Great Credit Score Isn’t Enough

You earn a good salary and your credit score is over 750, but Chase just denied your credit card application. How can this be? If you’ve opened 5 or more credit cards from any bank in the last 2 years, you just became the latest victim of the Chase 5/24 rule. Your good credit history is usually the most important prerequisite banks look for in order to approve you for a credit card. But with Chase’s unique credit card approval rule, your stellar credit takes a back seat to your potential profitability. Before applying for any Chase credit card, you’ll need to know what the Chase 5/24 rule is and if it applies to you. Here…

-

Should I Cancel a Credit Card I No Longer Use?

There are times when it makes sense to cancel a credit card, but it’s oftentimes better not to. In “Before You Cancel That Credit Card, Read This!“, I wrote about the effects that canceling a card have on your credit score–it can never help, only hurt your score. In this article, I’ll go through some of the more common reasons I see given for wanting to cancel a card and discuss the validity of each reason. I have too much available credit This is a common misconception in consumer finance. Banks actually prefer if you have a large and varied amount of available credit. Risk is reduced by spreading it out…

-

Citi Offer: 5000 AAdvantage Miles for Adding an Authorized User

I just received an email from Citi with a nice offer on one of my AAdvantage Platinum cards. Now, for a limited time, add an authorized user and spend $1,000 in purchases to receive 5,000 American Airlines AAdvantage® bonus miles by 06/30/2016. You’ll earn miles for their purchases, so your rewards add up even faster. I currently have 2 Citi AAdvantage Platinum cards after taking advantage of multiple 50k mile signup offers. My wife is already an authorized user on one. I received the offer on my most recent card, where I’m the only cardholder. According to the email, here’s all I need to do: Add an authorized user to your…

-

My Latest Credit Card Retention Call

It’s been a year since I was approved for my Chase United MileagePlus Explorer credit card. At the time, my account was targeted for 50,000 MileagePlus Miles after spending $3,000 in addition to the usual no annual fee for the first year. I was able to take advantage of that offer AND get a $50 statement credit for applying while booking a flight on United’s website. I never did complete the flight booking, I just wanted the $50 credit! This morning, I noticed that the $95 annual fee charge for the card appeared in my account, so it may be time to cancel. It’s not uncommon for credit card issuers…

-

Before You Cancel That Credit Card, Read This!

One question that I am asked frequently is: “Will it help or hurt my credit score if I cancel a credit card?” I can say with certainty that the singular act of cancelling a card will never help your score. And, depending on your credit profile, the negative impact could range from negligible to significant. In my article “Decoding Credit Score Mystery Math“, I explained the factors that make up your score. The three largest factors are: Payment History (35%), Credit Utilization (30%), and Average Age of Accounts (15%). Let’s have a look at how canceling a credit card impacts these factors. Payment History Some readers may feel that closing a credit card where they have…

-

10 Strategies to Increase Your Credit Score in 2016

Do you have big travel plans next year and want to apply for credit cards that offer rewards to help you get there for free? Or is 2016 the year you plan to become a homeowner? Then now is the time to spruce up your credit score. Here are 10 strategies you can use to get instant approvals on those rewards cards or the lowest possible rate on your mortgage. Check for Errors on Your Credit Report The first step to a better credit score is knowing what’s in your credit report. There are three companies that report on your credit: Equifax, Experian, and Transunion. Visit annualcreditreport.com for more information on obtaining…

-

7 Keys to Higher Credit Scores

It’s always a good time of year to review some basic steps to achieving higher credit scores. Here are 7 keys to getting instant approvals on those rewards credit cards or the lowest possible rate on your mortgage. Be Disciplined As is the case with most personal finance strategies, being disciplined is the key. The good news: thanks to the advent of technology, it’s much easier now than in the past to be disciplined in building your credit. If you fully commit yourself to the process of boosting your credit rating, higher scores–and the multitude of benefits and special offers that come with them–can be yours. Auto Pay Is Your Friend The…

-

Understanding your Credit Score–TIMES THREE!

When most people start on the journey to understand their credit score, they’re usually expecting to have just one number to deal with. You might be surprised to learn that you don’t have just one FICO Score, you have THREE! And they’re all different! While that seems unnecessarily confusing, and perhaps a bit daunting, here’s the good news—the same strategy can be used to boost all three scores, all at the same time. In this post, I’ll briefly explain why you have 3 credit scores, and why they’re all different, so that you can have a better understanding of my next post, which will give you the tools you’ll need…

-

Decoding Credit Score “Mystery Math”

Knowing what doesn’t affect your credit score is every bit as important as knowing what does. Deciphering the methodology used by the “credit score gods” can be intimidating, so PointsYak has done the work for you, breaking down the parts of your credit report that are used compute your score. Of course, only the folks at FICO know the exact math behind that final magical number, but here’s the bottom line on what hurts your score, what helps, and even a few things that—surprisingly—have no impact at all. Payment History How you’ve handled your monthly bills accounts for the largest portion of your overall credit score. Are you one of…

RECENT POSTS