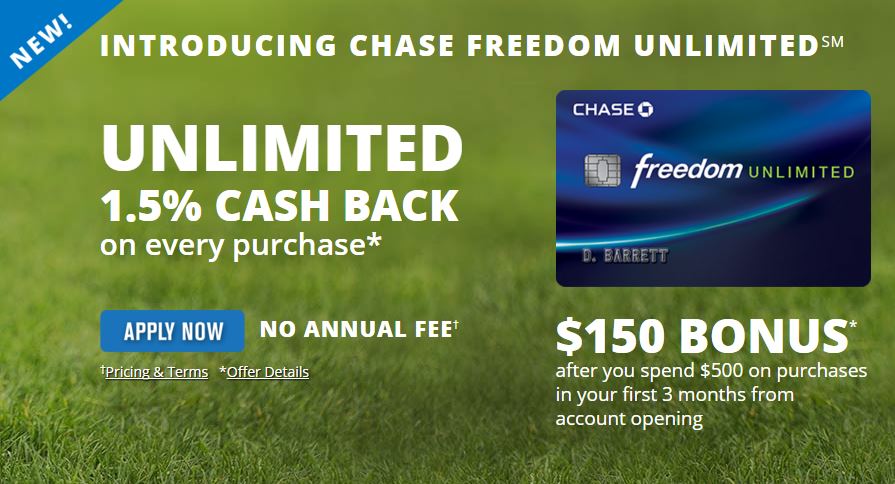

New Freedom Unlimited Credit Card from Chase

Chase has added another credit card to its Ultimate Rewards arsenal. The new Freedom Unlimited, unlike its sibling, has no category bonuses or quarterly activations. You earn 1.5 points on every dollar you spend–unlimited.

Freedom Unlimited is a great complement to Chase’s other Ultimate Rewards earning cards. Continue to use the other cards to spend in bonus categories. Freedom Unlimited is now the card to use for “everything else.”

Card Details

- 15,000 ($150) bonus points after you spend $500 on purchases in your first 3 months

- 2,500 ($25) bonus points when you add your first authorized user and make your first purchase in your first 3 months

- 1.5x Ultimate Rewards points on all purchases

- Rewards do not expire as long as your account is open.

- 0% Introductory APR for 15 months on purchases and balance transfers.

- No Annual Fee

Ultimate Rewards

While Chase calls each of its Freedom cards a cash back card, they actually earn Ultimate Rewards (UR) points that you can later exchange for cash.

While Chase calls each of its Freedom cards a cash back card, they actually earn Ultimate Rewards (UR) points that you can later exchange for cash.

There are actually two types of UR points depending on which Chase card you earned them with. One type that can be exchanged for cash and a second that can also be redeemed for travel rewards. Since both types of points use the same “Ultimate Rewards” name, it makes the entire program somewhat confusing.

Chase’s cashback cards (Freedom and Freedom Unlimited) earn the first type of points. They can only be redeemed for cash at certain merchants, for travel, or as a statement credit. The redemption value is always 1 cent/point.

The Chase Sapphire Preferred rewards card, earns the second type of UR points. In addition to the cash redemption, these points can be redeemed for travel at a higher rate (1.25 cents/point), or be transferred to various frequent flier and hotel loyalty programs. This is where you can generate redemption values of >2 cents/point.

The latter type of UR points are obviously more flexible and much more valuable, which is one of the reasons the Sapphire Preferred charges an annual fee–this article will help you decide if the extra value is worth the fee.

Chase’s One-Two Punch

Here’s the best part! If you hold either or both of Chase’s Freedom cards AND a Sapphire Preferred card, you can transfer points between them.

This valuable one-two punch lets you earn points at Freedom Unlimited’s 1.5x rate. Then, instead of simply redeeming for cash at 1 cent/point, transfer those points to your Sapphire Preferred card, where you can redeem them for travel rewards at a far greater value.

Chase 5/24 Rule When Applying for Credit Cards

It’s important to keep in mind Chase’s restrictive but unique approval process. In general, your application for any Chase Ultimate Reward earning personal credit card will be denied (regardless of your creditworthiness) if you have opened 5 or more credit cards from any bank in the past 24 months. This restriction appears to include any accounts where you have been added as an authorized user by the primary cardholder.

While this policy is not defined in any written terms & conditions anywhere, the restrictions are based on data provided by approval and denial data points. Bottom line: be prepared to be denied if you’ve been active with new credit card accounts in the last 2 years.

You can read my full article on Chase’s 5/24 Rule here.