-

When to Re-Apply for Chase Sapphire Reserve

Are you looking to re-apply for the Chase Sapphire Reserve card? Is it getting very close to 48 months since you got your last Sapphire welcome bonus? It may be closer than you think. The Chase Sapphire Reserve card was originally introduced over 4 years ago. At 50,000 points, the signup bonus is only half of what it was in its early days, but the card is still very popular despite the $550/yr annual fee. Those that were approved the card in its first months could be looking to apply again when eligible for another welcome bonus. But when is that exactly? First, lets look at the eligibility rule before…

-

60,000 Bonus Point Offer for Chase Sapphire Preferred

Chase has upped the signup bonus on its Sapphire Preferred credit card to 60,000 Ultimate Rewards points after spending $4,000 on purchases in the first 3 months. With this increased bonus, the annual fee of $95 is not waived for the first year. The normal bonus is 50,000 points after spending $4,000 in 3 months with no annual fee the first year. Application Link Effectively, this new offer is like spending $95 for 10,000 Ultimate Rewards points. That’s a good deal even if you plan to redeem UR points for cash. At the same time, there are those who, in principle, refuse to sign up for a card that carries an…

-

Extra Points by Using Chase Sapphire Card and Digital Wallet

From now through November 4, 2017, some Chase credit cards will earn an extra point if you pay using a digital wallet. Just use your Chase Sapphire, Sapphire Preferred, or Sapphire Reserve in Android Pay, Apple Pay, Samsung Pay or Chase Pay. You’ll earn 1 additional Ultimate Rewards point per $1 spent–up to $1,500 during the promotional period. This is a simple way to earn extra points on everyday purchases. By using your Sapphire card and digital wallet, you’ll earn at least 2x UR points on all spending and up to 4x UR points on travel & dining if you have the Sapphire Reserve. It’s completely automatic–there’s nothing you need…

-

Chase Limits New Sapphire Card Signups

One year after launching the incredibly popular Sapphire Reserve card, Chase has placed new restrictions on eligibility for new Sapphire Credit Card products (Sapphire Reserve, Sapphire Preferred, and Sapphire). If you currently have any one of those 3 cards OR if you’ve received a signup bonus from ANY of those cards in the last 24 months, you will not be approved for a new Sapphire product. Here’s the language directly from chase.com: This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 24 months. If you are an existing Sapphire customer and would…

-

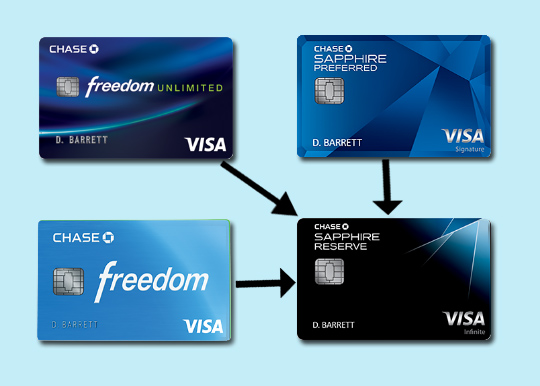

Should You Cancel Sapphire Preferred after getting the Reserve Card?

Congratulations! You’ve been approved for the extremely popular Chase Sapphire Reserve credit card! Now what should you do with the your other Ultimate Rewards earning cards like Freedom and Freedom Unlimited? Should you cancel Sapphire Preferred? The answer is different for each card. There’s no reason to cancel the cards that don’t charge an annual fee, but Sapphire Preferred does and also shares many of the same benefits as Sapphire Reserve. I’ll go through each card and explain what your options are. Background Having additional Chase credit cards that earn Ultimate Rewards is a great complement to the Sapphire Reserve. You can earn points by purchasing goods and services with one card, then…

-

How to Transfer Chase Points to the Sapphire Reserve Card

Chase has a number of credit cards that earn points in the Ultimate Rewards program, and depending on how you redeem them, they could have a different value. I’ll show you how to transfer your points to the card that gives them the highest value–Chase Sapphire Reserve. The Chase credit cards that earn UR points are: Freedom, Freedom Unlimited, Sapphire, Sapphire Preferred, Sapphire Reserve, and business cards such as Ink Cash, Ink Unlimited, Ink Preferred. While each card shares the “Ultimate Rewards” name, there are differences in how you can redeem your points among those cards. The good news is that you can earn points in each card’s generous bonus categories, then…

-

Higher Credit Card Signup Bonuses In Chase Branches vs Online

There are multiple reports by Reddit Churning users who are seeing higher signup bonus offers in Chase bank branches than the normal bonuses online. These offers appear to be targeted to certain pre-approved customers so YMMV. Most of the Miles and Points blogs are not reporting on this since they are paid referral fees for credit card signups via their own online links. Sending readers to branches to apply for credit cards is bad for their business. This could be the beginning of Chase attempting to rein in some referral costs. Sapphire Preferred – 70,000 point bonus So far, the credit cards offering higher bonuses are Chase Sapphire Preferred and Chase…

-

Chase Sapphire Reserve – Post Denial Options

After applying for Chase Sapphire Reserve in a bank branch earlier this week, I finally decided to call the reconsideration line to check the status. As I feared, my application was denied due to too many accounts opened in the past 24 months. I asked the representative “How many is too many accounts?” She was polite but would not put a number on it. I had considered waiting to let the decision process play out on its own–some have had more luck being approved that way. I finally considered calling for two reasons: There might be a need to move some credit around which could be causing the delay. I have 3 additional recently…

-

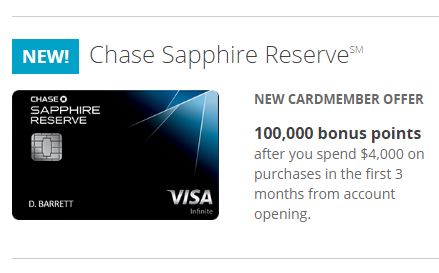

The New Chase Sapphire Reserve Card Looks Fantastic!

UPDATE: The 100,000 point signup bonus offer for online applications will be reduced to 50,000 on January 12, 2017. Chase has introduced its new premium travel credit card, Sapphire Reserve, and it looks fantastic! Loaded with benefits, it carries a hefty $450 annual fee. This new addition to its lineup finally gives Chase a direct competitor to The Platinum Card from American Express and Citi Prestige. Sapphire Reserve offers a myriad of travel benefits that more than make up for the annual fee, including an annual $300 travel credit, complimentary Priority Pass airport lounge access, and Global Entry/TSA Pre✓ credit. Unfortunately, this card is subject to Chase’s restrictive 5/24 rule. Last week, I wrote…

-

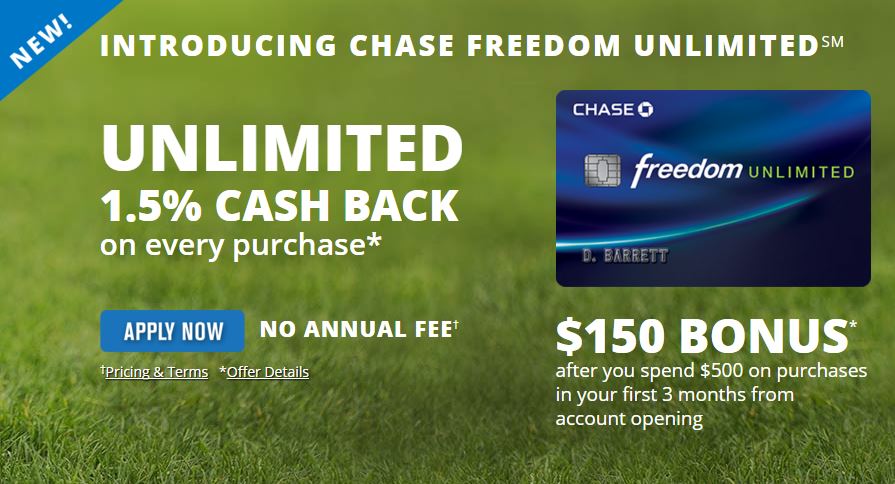

New Freedom Unlimited Credit Card from Chase

Chase has added another credit card to its Ultimate Rewards arsenal. The new Freedom Unlimited, unlike its sibling, has no category bonuses or quarterly activations. You earn 1.5 points on every dollar you spend–unlimited. Freedom Unlimited is a great complement to Chase’s other Ultimate Rewards earning cards. Continue to use the other cards to spend in bonus categories. Freedom Unlimited is now the card to use for “everything else.” Card Details 15,000 ($150) bonus points after you spend $500 on purchases in your first 3 months 2,500 ($25) bonus points when you add your first authorized user and make your first purchase in your first 3 months 1.5x Ultimate Rewards points on all…

RECENT POSTS