Credit Cards

-

Many Helpful New Amex Offers for Graduation Gift Buying

American Express has added quite a few new offers for targeted cardholders in the past few days, many of which can save you money on a gift for your graduating senior. Whether it’s a new laptop, the gift of travel, dorm room supplies, or even crayons, American Express has a money saving offer for you. The Amex Offers program is one of my favorite credit card perks. You can read my primer on how the program works here. In addition, you can stack these offers with additional cash back or frequent flyer miles by shopping via an online portal. Once again, most of these offers are targeted. You may see some,…

-

Review: Capital One Venture Credit Card

Last week, I wrote a review of the BarclayCard Arrival Plus Credit Card. The Arrival Plus card and Capital One’s Venture share many similarities and lead me to the same conclusion. Capital One Venture’s signup bonus is worth $400 towards travel expenses and that is certainly worth the effort, but like Arrival Plus, the value ends there. Card Details Earn 40,000 bonus miles after you spend $3,000 on purchases in the first 3 months Earn unlimited 2X miles on all purchases Visa Signature Benefits No foreign transaction fees $59 annual fee (waived the first year) Analysis Capital One Venture uses the word “miles” to describe the rewards that you earn when you…

-

Review: BarclayCard Arrival Plus Credit Card

The BarclayCard Arrival Plus Credit Card comes with a generous signup bonus worth $400 when redeemed towards travel costs. The bonus alone is reason enough to apply for this card. Unfortunately, it may be the only reason. Don’t get me wrong, the Arrival Plus has some great benefits. But once you factor in the annual fee which kicks in after the first year, there are better credit card options. Let’s start with the basics. Card Details Earn 40,000 bonus miles after you spend $3,000 on purchases in the first 90 days Earn 2X miles on all purchases Get 5% miles back after each redemption 0% intro APR for 12 months on balance transfers…

-

Amex Blue Cash Everyday or Preferred. Which is Right For You?

UPDATE: The Annual Fee for the Blue Cash Preferred Card is increasing to $95 on 8/3/16. See my updated post here. There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could be well worth paying. Lets compare the two popular cash back credit cards offered by American Express–one that charges an annual fee and one that doesn’t–Blue Cash Everyday and Blue Cash Preferred. I’ll walk you through the extra benefits and do all the necessary math…

-

This Credit Card Will Pay You $120/yr With Little Spend

Cash back credit cards generally base their rewards on how much you use the card. The more you spend, the more you earn. The BankAmericard Better Balance Rewards card is different–it rewards you for responsibly managing your credit card balance. With this card, you can earn up to $30 per quarter when you pay more than your monthly minimum on time each month. There’s no minimum spend requirement, but you need to have a statement balance each month. Lets look at the card basics before going through the process. Card Details Earn $25 per quarter when you pay more than the monthly minimum on time each month–that can be up to…

-

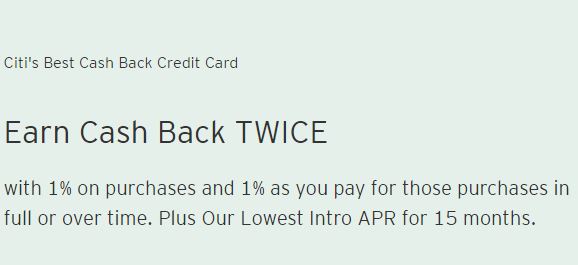

What’s the Best Cash Back Credit Card if You Only Want One Card?

If you like cash back credit cards and prefer simplicity, consider the Double Cash card offered by Citi. There are no category bonuses or quarterly activations to keep track of, just 2% back on all your spending. I generally don’t advocate having only one credit card as I feel that multiple cards are the best way to maximize bonuses. That being said, there are those prefer a single go-to card for all purchases. For them, I always recommend Citi Double Cash. This card has merit even if you have multiple cash back credit cards (one for groceries, one for gas, etc.), there is always that “everything else” category that no…

-

New Amex Offers for Double Membership Rewards Points

American Express has come out with a number of new offers on their cards that earn Membership Rewards. For select online retailers, you can earn 2x Membership Rewards points on your purchases through December 31, 2016. These offers are not as lucrative as the cash incentives we often see with this program, but I might consider using an Amex card for some of these purchases for the extra point. In addition, you can stack these offers by shopping via an online portal for even more rewards. The Amex Offers program is one of my favorite credit card perks. You can read my primer on how the program works here. Amazon Offer Last week,…

-

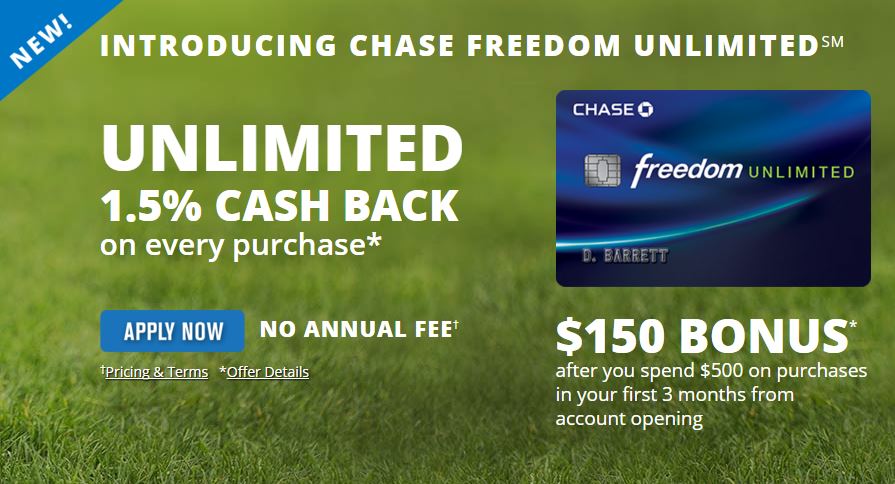

New Freedom Unlimited Credit Card from Chase

Chase has added another credit card to its Ultimate Rewards arsenal. The new Freedom Unlimited, unlike its sibling, has no category bonuses or quarterly activations. You earn 1.5 points on every dollar you spend–unlimited. Freedom Unlimited is a great complement to Chase’s other Ultimate Rewards earning cards. Continue to use the other cards to spend in bonus categories. Freedom Unlimited is now the card to use for “everything else.” Card Details 15,000 ($150) bonus points after you spend $500 on purchases in your first 3 months 2,500 ($25) bonus points when you add your first authorized user and make your first purchase in your first 3 months 1.5x Ultimate Rewards points on all…

-

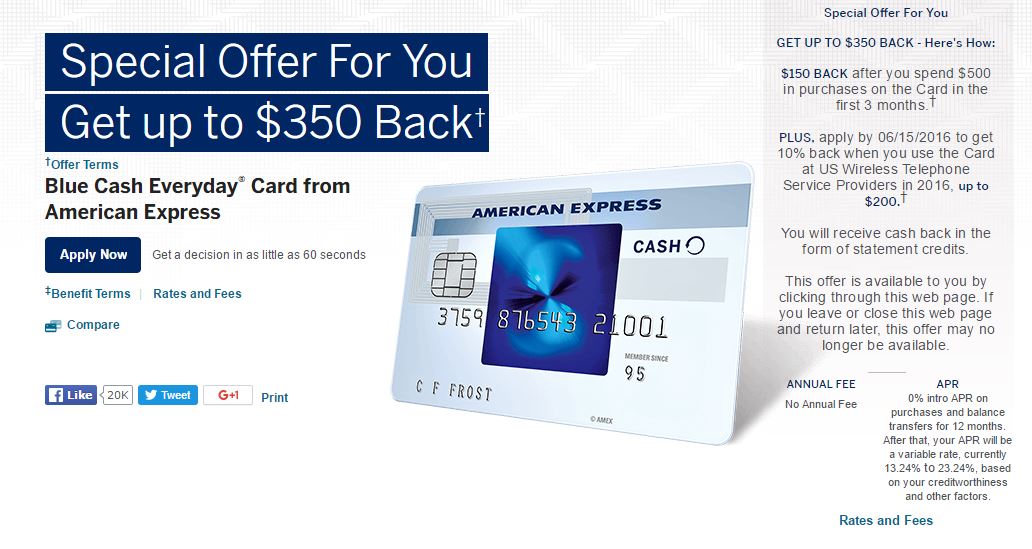

Unique Credit Card Signup Offer for Amex Blue Cash Everyday

American Express has announced a unique promotion for new customers applying for their Blue Cash Everyday Card. This offer could potentially be worth $350–not bad for a no annual fee card–but there are some caveats. The regular signup bonus for this card is $100 cashback in the form of a statement credit after spending $1000 in the first 3 months after approval. If you are a targeted customer (or if you use your browser’s “incognito” window), this offer may be as high as $150. In addition to the regular cashback incentive, the promotional bonus offers 10% credit on purchases at U.S. Wireless Telephone Service Providers up to $200 through the end…

-

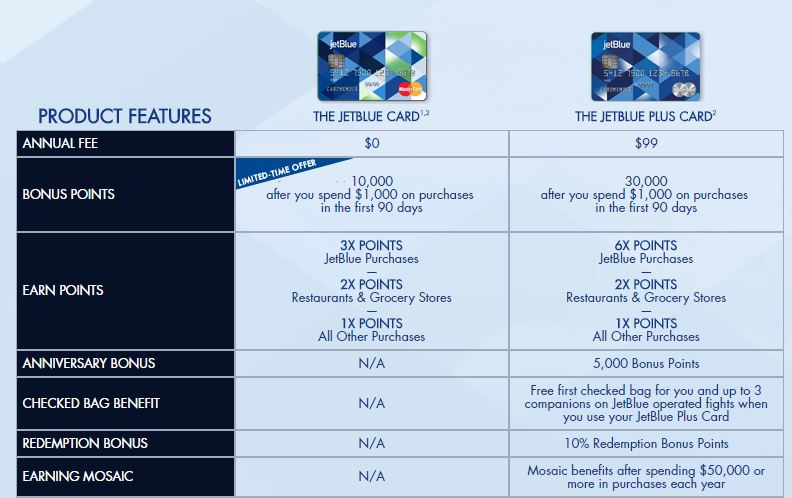

New JetBlue Credit Cards: Which One is Best?

You can now apply for three new JetBlue credit cards: the no annual fee JetBlue Card, and the $99 annual fee JetBlue Plus and JetBlue Business cards. I’ll compare the benefits of each card so you can decide which is best for you. JetBlue recently moved their credit card branding partnership from American Express to Barclays. Those customers who had the old American Express version have been automatically transferred to a new Barclays JetBlue Rewards card with fees and benefits that are similar to those that were offered by their old American Express version. You can’t apply for that “replacement” card, however this week, Barclays began to accept applications for…