Should I Cancel a Credit Card I No Longer Use?

There are times when it makes sense to cancel a credit card, but it’s oftentimes better not to. In “Before You Cancel That Credit Card, Read This!“, I wrote about the effects that canceling a card have on your credit score–it can never help, only hurt your score.

In this article, I’ll go through some of the more common reasons I see given for wanting to cancel a card and discuss the validity of each reason.

I have too much available credit

This is a common misconception in consumer finance. Banks actually prefer if you have a large and varied amount of available credit. Risk is reduced by spreading it out among many lenders. When you close a credit card, you reduce the amount of your available credit and reduce the number of lenders by one–both of these factors may reduce your score.

I have too many credit cards

In my opinion, there’s no such thing as “too many credit cards.” Each one likely provides a different benefit or reward and you don’t need to carry every card in your wallet or purse at all times. Each card’s credit line helps your utilization percentage and your credit score, so hold onto them, even if that’s the only benefit they provide.

I want to reduce my risk of fraud

The premise here is that the more credit cards you have, the greater the chance of becoming victim to having your information stolen and used fraudulently. I would argue that the most likely time for your information to be compromised is at the point of purchase. In other words, a credit card sitting in your sock drawer is not likely to be stolen.

I missed a payment once

Some may feel that closing a credit card where they have a history of one or more late payments will help to clean up their credit profile. Unfortunately, delinquencies stay on your credit report for 7 years, and closing the account won’t sweep these under the rug. The only thing that will heal any blemishes on your credit report is time.

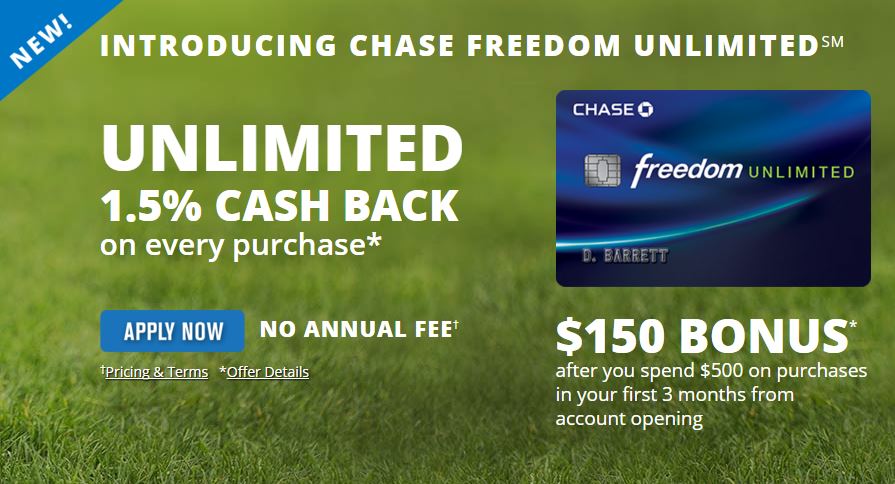

I don’t want to pay the annual fee

This is a valid reason for canceling a credit card if the value of the benefits you receive are less than the amount of the annual fee. Call your credit card issuer first to see if they will offer you an incentive to offset the fee, or if there is a version of the card with no annual fee to downgrade to. If not, then go ahead and cancel.

I want to qualify for the new customer signup bonus again

For more advanced readers who enjoy receiving signup bonuses repeatedly, this may also be a good reason to cancel a card. You need to know the bonus terms of each card. For example, some Citi card signup bonuses are not available if you’ve opened or closed the same card in the last 24 months. In this case, you need to apply for the new card before you close the old one that you’ve had open for at least 2 years. Another example: American Express card signup bonuses are once per lifetime, so closing your old card doesn’t matter.

Bottom Line

The decision to cancel a credit card should always be a practical decision, never an emotional one. Think about your reasons for wanting to cancel and consider any repercussions before you make your final decision.