Decoding Credit Score “Mystery Math”

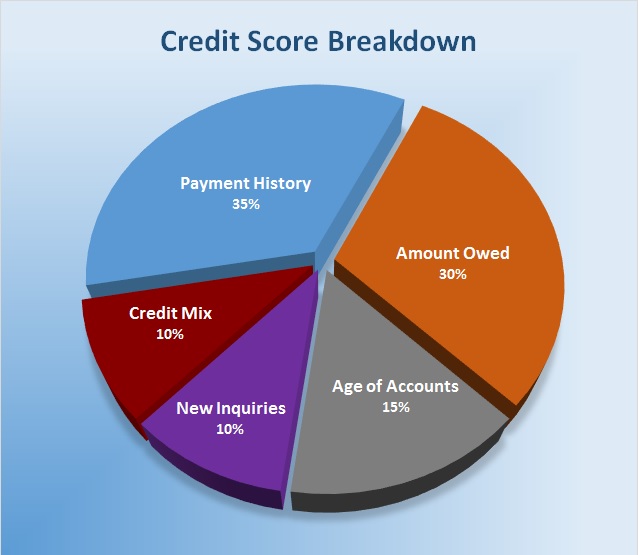

Knowing what doesn’t affect your credit score is every bit as important as knowing what does. Deciphering the methodology used by the “credit score gods” can be intimidating, so PointsYak has done the work for you, breaking down the parts of your credit report that are used compute your score. Of course, only the folks at FICO know the exact math behind that final magical number, but here’s the bottom line on what hurts your score, what helps, and even a few things that—surprisingly—have no impact at all.

Payment History

Payment History

How you’ve handled your monthly bills accounts for the largest portion of your overall credit score. Are you one of those fortunate, vigilant souls who has made EVERY payment you’ve EVER owed, EVERY month, RIGHT ON TIME? If so, then congratulations (and, wow!) on satisfying the most important component of a good credit score. Keep up the great work!

If you haven’t, don’t panic. One or two missed payments are not the end of the world—time will eventually erase those lapses. After 7 to 10 years, any missed payments will drop off your credit report and no longer be a drag on your score. And, fortunately, there are a few things you can do while you wait to help minimize the impact of that history (keep reading!).

Amounts Owed: Maintain a Good Ratio

Simply put: banks don’t like if you max out your credit cards every month, so FICO reflects that in its scoring. No matter how many cards you have, keeping your utilization below 20% of your overall credit limit will go a long way to raising your score. For example: if you have $5,000 aggregate limit across all of your cards, don’t let more than $1,000 in total hit your credit card statements. Much more on this subject in future posts.

Age of Accounts: Building a Track Record

A long history of on-time payments helps reassure creditors that the responsible trend will continue. If all of your loans are recent, there’s no reliable precedent set by you yet, and this will be reflected in your score. Were you thinking about cancelling that retail store credit card you opened when you were 19 years old but no longer use? Think again. Keeping it active actually helps your credit score.

New Inquiries: Know When to Say No

We know, it can be SO tempting when you’re at that cash register ringing up your purchases, and the smiling sales clerk says, “Would you like to save 15% today by opening an account with us?” Well, who wouldn’t? But think carefully before you add more plastic to your wallet. Every time you apply for a new credit card, your credit history is pulled, and too many pulls are not a good thing. Whether you are approved or not, if you apply for 20 credit cards in a week, you WILL damage your credit score. (Hopefully that example sounds as extreme to you as I have intended it to be, but with the holidays fast approaching, one can never be too sure.)

Credit Mix: Diversity is Good!

While too much debt is never a good thing, having a blend of debt types–a car payment, credit card accounts, a student loan and a mortgage– is preferable to having one, massive student loan. A good mix means that various types of lenders have extended you credit. FICO likes that!

What Doesn’t Matter?

You might be surprised at some of the seemingly-wonderful things that have absolutely no effect on your credit score. Did you just get a fabulous new job and double your annual income? Congratulations! That’s great news! However, FICO doesn’t care. They also don’t care if you moved to a nicer zip code, earned a fancy law degree, married your high school sweetheart, and had triplets. While certainly life-changing on a personal level, when it comes to your credit score, none of it matters.

And last but not least: don’t close down that problem credit card account: you know, the one that you missed a payment or two on in the past? As I’ll cover in my next post, not only will it not help your score, it could lower it even further by reducing both your total available credit AND age of accounts!