-

Review: Capital One Venture Credit Card

Last week, I wrote a review of the BarclayCard Arrival Plus Credit Card. The Arrival Plus card and Capital One’s Venture share many similarities and lead me to the same conclusion. Capital One Venture’s signup bonus is worth $400 towards travel expenses and that is certainly worth the effort, but like Arrival Plus, the value ends there. Card Details Earn 40,000 bonus miles after you spend $3,000 on purchases in the first 3 months Earn unlimited 2X miles on all purchases Visa Signature Benefits No foreign transaction fees $59 annual fee (waived the first year) Analysis Capital One Venture uses the word “miles” to describe the rewards that you earn when you…

-

Review: BarclayCard Arrival Plus Credit Card

The BarclayCard Arrival Plus Credit Card comes with a generous signup bonus worth $400 when redeemed towards travel costs. The bonus alone is reason enough to apply for this card. Unfortunately, it may be the only reason. Don’t get me wrong, the Arrival Plus has some great benefits. But once you factor in the annual fee which kicks in after the first year, there are better credit card options. Let’s start with the basics. Card Details Earn 40,000 bonus miles after you spend $3,000 on purchases in the first 90 days Earn 2X miles on all purchases Get 5% miles back after each redemption 0% intro APR for 12 months on balance transfers…

-

Amex Blue Cash Everyday or Preferred. Which is Right For You?

UPDATE: The Annual Fee for the Blue Cash Preferred Card is increasing to $95 on 8/3/16. See my updated post here. There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could be well worth paying. Lets compare the two popular cash back credit cards offered by American Express–one that charges an annual fee and one that doesn’t–Blue Cash Everyday and Blue Cash Preferred. I’ll walk you through the extra benefits and do all the necessary math…

-

Citi Offer: 5000 AAdvantage Miles for Adding an Authorized User

I just received an email from Citi with a nice offer on one of my AAdvantage Platinum cards. Now, for a limited time, add an authorized user and spend $1,000 in purchases to receive 5,000 American Airlines AAdvantage® bonus miles by 06/30/2016. You’ll earn miles for their purchases, so your rewards add up even faster. I currently have 2 Citi AAdvantage Platinum cards after taking advantage of multiple 50k mile signup offers. My wife is already an authorized user on one. I received the offer on my most recent card, where I’m the only cardholder. According to the email, here’s all I need to do: Add an authorized user to your…

-

This Credit Card Will Pay You $120/yr With Little Spend

Cash back credit cards generally base their rewards on how much you use the card. The more you spend, the more you earn. The BankAmericard Better Balance Rewards card is different–it rewards you for responsibly managing your credit card balance. With this card, you can earn up to $30 per quarter when you pay more than your monthly minimum on time each month. There’s no minimum spend requirement, but you need to have a statement balance each month. Lets look at the card basics before going through the process. Card Details Earn $25 per quarter when you pay more than the monthly minimum on time each month–that can be up to…

-

What’s the Best Cash Back Credit Card if You Only Want One Card?

If you like cash back credit cards and prefer simplicity, consider the Double Cash card offered by Citi. There are no category bonuses or quarterly activations to keep track of, just 2% back on all your spending. I generally don’t advocate having only one credit card as I feel that multiple cards are the best way to maximize bonuses. That being said, there are those prefer a single go-to card for all purchases. For them, I always recommend Citi Double Cash. This card has merit even if you have multiple cash back credit cards (one for groceries, one for gas, etc.), there is always that “everything else” category that no…

-

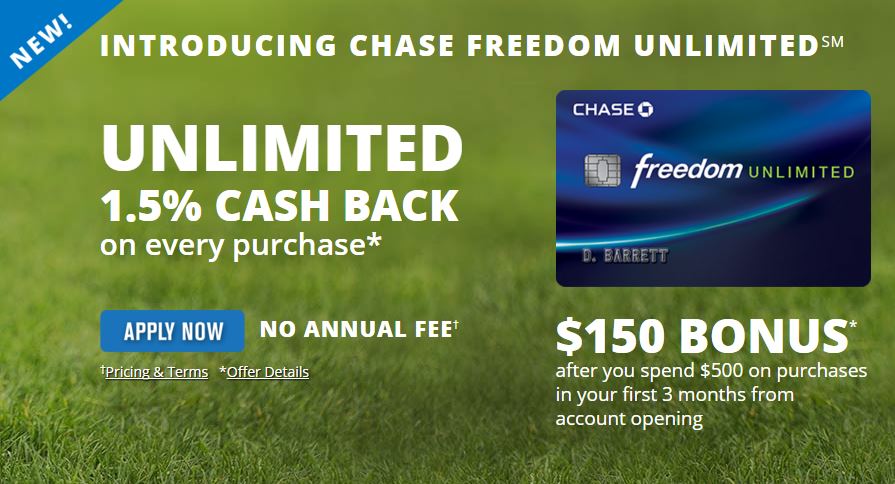

New Freedom Unlimited Credit Card from Chase

Chase has added another credit card to its Ultimate Rewards arsenal. The new Freedom Unlimited, unlike its sibling, has no category bonuses or quarterly activations. You earn 1.5 points on every dollar you spend–unlimited. Freedom Unlimited is a great complement to Chase’s other Ultimate Rewards earning cards. Continue to use the other cards to spend in bonus categories. Freedom Unlimited is now the card to use for “everything else.” Card Details 15,000 ($150) bonus points after you spend $500 on purchases in your first 3 months 2,500 ($25) bonus points when you add your first authorized user and make your first purchase in your first 3 months 1.5x Ultimate Rewards points on all…

-

Should You Pay the Annual Fee for the Chase Sapphire Preferred?

Chase Sapphire Preferred (CSP) provides a number of additional benefits that the Chase Freedom card doesn’t offer. However, those extras come at a cost. After being waived the first year, the annual fee of $95 will kick in. Is it worth paying? I’ll walk you through the extra benefits and do the math for you with a calculator at the end of this article. The premise behind this exercise is that you are deciding whether to keep your CSP and pay the annual fee or downgrade it to a Freedom card to save the $95 (or simply cancel if you already have a Freedom). To make this determination, my calculator requires only 4 variables:…

-

Amex SPG 35k Signup Bonus for Limited Time

American Express is offering a limited time increased signup bonus for its Starwood Preferred Guest Personal and Business credit cards. You can get 35,000 bonus Starpoints after you use the new Card to make $3,000 in purchases within the first 3 months. The signup bonus is normally 25,000 Starpoints and I’ve only seen it as high as 30,000 in the past. This limited time offer ends March 30, 2016. Starpoints are a favorite for travelers not just because they have high value when you redeem at Starwood properties like Sheraton, Westin, and W Hotels. Starpoints can also be transferred directly to miles in your frequent flyer program with a 1:1 Starpoints-to-miles exchange rate…

-

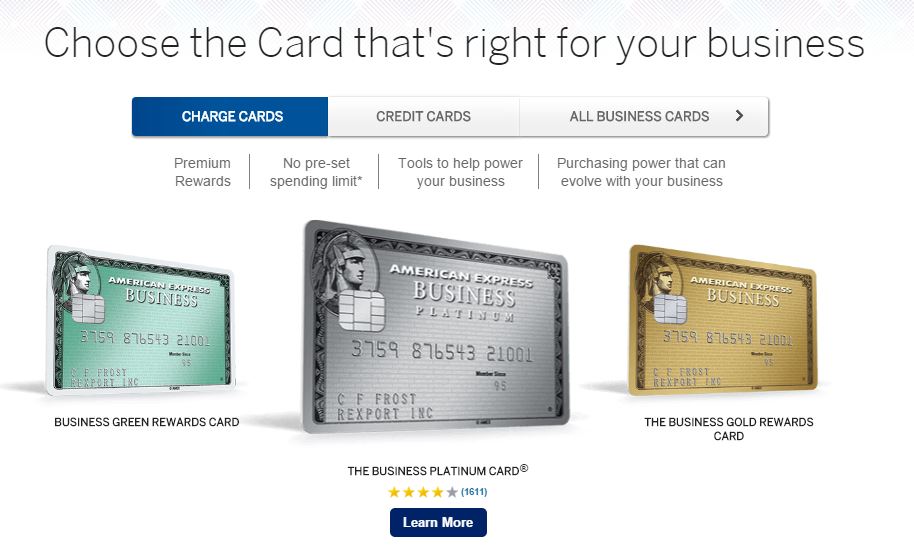

New Rules for Amex Business Card Signup Bonuses

American Express changed the offer terms on their line of business credit cards last week. Unfortunately, the change is not positive. Last year, American Express limited the eligibility of signup bonuses to once per lifetime for its personal credit cards. Specifically, the language reads as follows: “Welcome bonus offer not available to applicants who have or have had this product.” Translated, this means that if you’re applying for a personal card like the Preferred Rewards Gold card, you are ineligible for the bonus if you’ve ever had that same card before. Until last week, business card applications were not subject to that same restriction. Those offer terms had the language…

RECENT POSTS