-

Should I Cancel a Credit Card I No Longer Use?

There are times when it makes sense to cancel a credit card, but it’s oftentimes better not to. In “Before You Cancel That Credit Card, Read This!“, I wrote about the effects that canceling a card have on your credit score–it can never help, only hurt your score. In this article, I’ll go through some of the more common reasons I see given for wanting to cancel a card and discuss the validity of each reason. I have too much available credit This is a common misconception in consumer finance. Banks actually prefer if you have a large and varied amount of available credit. Risk is reduced by spreading it out…

-

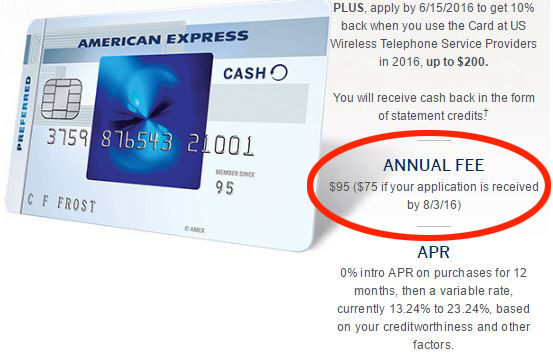

Amex Blue Cash Preferred Raising Annual Fee

Beginning August 3, 2016, the Annual Fee for the American Express Blue Cash Preferred credit card is increasing from $75 to $95. There’s been no announcement other than the notation on the web-based application. There is also no indication of any enhancement to the card’s benefits. The rest of this post is an update of Amex Blue Cash Everyday of Preferred. Which is Right For You? There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could…

-

United Credit Card Offering 50k-70k Bonus Miles

For a limited time, the Chase United MileagePlus Explorer card is offering an increased signup bonus. You can get 50,000 Bonus Miles after you spend $3,000 on purchases in the first 3 months your account is open. If your United MileagePlus account is targeted, that bonus might be 70,000 instead. This offer expires on June 30, 2016. The signup bonus is normally 30,000 miles after spending $1,000 in the first 3 months with the $95 annual fee waived for the first year. It’s important to note that with these limited time offers, the annual fee is not waived and will appear on your first statement. This product is not available to either (i)…

-

Chase Adds Flying Blue to Ultimate Rewards Partners

Chase has added a new partner to its Ultimate Rewards program. Effective immediately, you can now transfer your UR points to Flying Blue, the frequent flyer program of Air France and KLM. In addition to those airlines, Flying Blue miles can be redeemed for reward flights on SkyTeam Member Airlines like Delta, AlItalia, and AeroMexico. Flying Blue had already been a transfer partner of American Express Membership Rewards, Citi Thank You Rewards, and Starwood Preferred Guest. As with all of Chase’s other travel partners, UR points transfer to Flying Blue at a 1:1 ratio in increments of 1,000 points. FlyingBlue adds to the current list of Chase Ultimate Rewards airline partners:…

-

Which Credit Cards Pay For Global Entry or TSA PreCheck?

Long security lines at U.S. airports is commonplace during the summer travel season and this year should be no different. TSA Pre✓ gives trusted travelers the benefit of shorter lines and expedited screening. There is an application fee, but I’ll show you how to sign up for free. The U.S. Department of Homeland Security is encouraging travelers to sign up for TSA Pre✓ to help alleviate the delays: This is predicted to be one of the busiest air travel summers the airline industry has seen in a very long time and with more people flying, lines are expected to grow at TSA checkpoints. Travelers who are enrolled in TSA Pre✓or one…

-

Hot: Amex Personal Platinum Card 100k Bonus

UPDATE: This offer is no longer available. Thanks to ChetHazelEyes over at Reddit Churning for the alert about this fantastic offer. Apply now for the Personal Platinum Card from American Express and get 100,000 Membership Rewards points after spending $3000 with the card in the first 3 months. This offer is not available to applicants who have or have had this product in the past. The link to this offer can be found here. It takes you to the landing page with all the offer terms spelled out. Note that, as usual, the $450 annual fee is not waived the first year. Main Platinum Card Benefits I consider the Platinum Card to be…

-

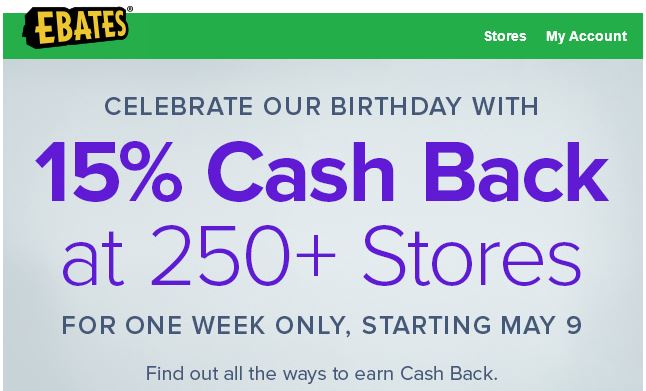

Celebrate Ebates’ Birthday With 15% Cash Back

To celebrate its birthday, Ebates is having a 15% Cash Back Party, featuring over 250 stores. The celebration begins on May 9 and will last one week. Doing your online shopping through a portal is a great way to earn extra cashback in addition to rewards earned with your credit card. I’ve always found the popular Ebates to be very competitive and reliable. What is a shopping portal? In short, a shopping portal is a website that provide links to various internet retailers. In return for directing customers to their site, those retailers pay a commission to the portal for each customer that makes a qualifying purchase. The portal then allots a portion of…

-

$20 Starbucks E-gift Card for $10 with Visa Checkout

To me, one of the only things better than coffee is FREE coffee. That’s why I’m excited about the current promotion from Starbucks and Visa Checkout. Be one of the first 325,000 to buy a Starbucks eGift Card (min $10) using Visa Checkout between 5/3/16 – 5/17/16 and Starbucks will add an additional $10, courtesy of Visa Checkout. It’s important to note, this doesn’t mean you simply checkout by paying with a Visa card. You need to sign up for a Visa Checkout account and add at least one payment method to it. Visa Checkout is a digital wallet service similar to paypal. According to their website: It’s simple to sign…

-

Many Helpful New Amex Offers for Graduation Gift Buying

American Express has added quite a few new offers for targeted cardholders in the past few days, many of which can save you money on a gift for your graduating senior. Whether it’s a new laptop, the gift of travel, dorm room supplies, or even crayons, American Express has a money saving offer for you. The Amex Offers program is one of my favorite credit card perks. You can read my primer on how the program works here. In addition, you can stack these offers with additional cash back or frequent flyer miles by shopping via an online portal. Once again, most of these offers are targeted. You may see some,…

-

Review: Capital One Venture Credit Card

Last week, I wrote a review of the BarclayCard Arrival Plus Credit Card. The Arrival Plus card and Capital One’s Venture share many similarities and lead me to the same conclusion. Capital One Venture’s signup bonus is worth $400 towards travel expenses and that is certainly worth the effort, but like Arrival Plus, the value ends there. Card Details Earn 40,000 bonus miles after you spend $3,000 on purchases in the first 3 months Earn unlimited 2X miles on all purchases Visa Signature Benefits No foreign transaction fees $59 annual fee (waived the first year) Analysis Capital One Venture uses the word “miles” to describe the rewards that you earn when you…

FEATURED POSTS

RECENT POSTS