Chase Freedom: A Cashback Card with a Twist

Still can’t decide between cashback or rewards credit cards? The Chase Freedom is a great card for those just starting out. This card gives you the “freedom” to make your cashback/rewards choice at a later date. And, right now is a great time to apply for the card. The sign-up bonus has been temporarily increased to $150 (normally $100) and between now and December 31, 2015, you’ll earn 10% instead of 5% cash back at Amazon, Zappos, Audible, and Diapers.com.

Still can’t decide between cashback or rewards credit cards? The Chase Freedom is a great card for those just starting out. This card gives you the “freedom” to make your cashback/rewards choice at a later date. And, right now is a great time to apply for the card. The sign-up bonus has been temporarily increased to $150 (normally $100) and between now and December 31, 2015, you’ll earn 10% instead of 5% cash back at Amazon, Zappos, Audible, and Diapers.com.

Ultimate Rewards

While Chase calls Freedom a cash back card, it actually earns Ultimate Rewards (UR) points that you can later exchange for cash.

While Chase calls Freedom a cash back card, it actually earns Ultimate Rewards (UR) points that you can later exchange for cash.

There’s actually two types of UR points. One type that can be exchanged for cash and a second that can also be redeemed for travel rewards. Since both types of points use the same “Ultimate Rewards” name, it makes the entire program somewhat confusing.

Cashback cards, such as the Freedom, earn the first type of points. They can only be redeemed for cash at certain merchants or as a statement credit. The redemption value is always 1 cent/point.

The Chase Sapphire Preferred rewards card, which I’ll write about in a future post, earns the second type of Ultimate Rewards points. In addition to the cash redemption, these points can be redeemed for travel at 1.25 cents/point, or be transferred to various frequent flier and hotel loyalty programs.

The latter type of UR points are obviously more flexible and therefore more valuable, which is one of the reasons the Sapphire Preferred charges an annual fee.

Chase’s One-Two Punch

There’s one other feature of the Ultimate Rewards program that gives the Freedom its hybrid quality: if you hold both the Freedom and Sapphire Preferred cards, you can transfer points between them.

This valuable one-two punch lets you earn points at a high rate in Freedom’s category bonuses, like the current 10% at Amazon. Then, instead of simply redeeming for cash at 1 cent/point, transfer those points to your Sapphire Preferred card, where you can redeem them for travel rewards at a far greater value.

Starting with the Freedom allows you to earn points now, and at any point in the future, you can decide whether you’d like to take the cash, or apply for the Sapphire Preferred and use that card’s redemption options.

Important Restrictions When Applying for Chase Cards

Another reason to start out with Freedom as one of your first cards is Chase’s somewhat restrictive but unique approval process. In general, your application for any Chase Ultimate Reward earning personal credit card will be denied (regardless of your creditworthiness) if you have opened 5 or more credit cards from any bank in the past 24 months. This restriction appears to include any accounts where you have been added as an authorized user by the primary cardholder.

While this policy is not defined in any written terms & conditions anywhere, the restrictions are based on data provided by approval and denial data points. You can read through this Flyertalk thread or its wiki if you’d like empirical evidence. Bottom line: don’t waste an application if you’ve been active with new credit card accounts in the last 2 years.

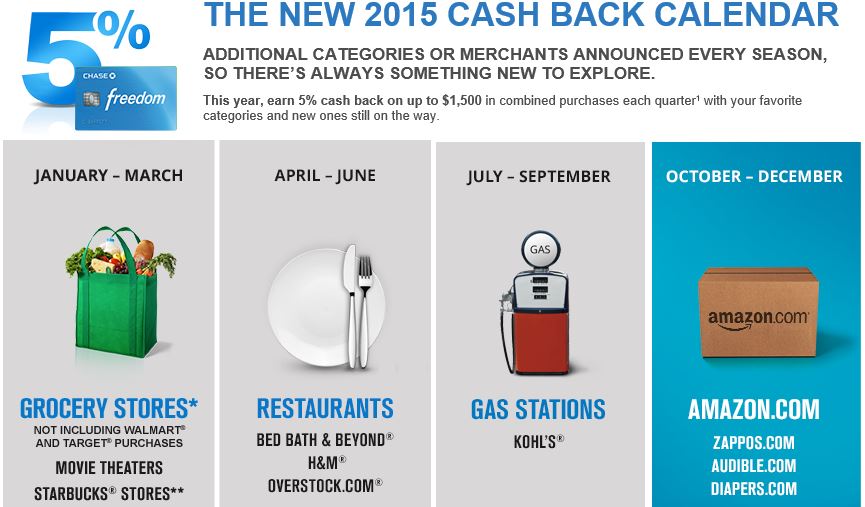

Cashback Category Bonuses

Chase Freedom is unique in that it doesn’t have fixed category bonuses. It offers 5% cashback in categories that rotate each quarter. Freedom requires that you activate the bonus categories before a deadline in order to receive the extra cash—a simple process, but one that you must remember to follow through on. You can earn a maximum of $1,500 cashback bonuses (150,000 Ultimate Rewards points) each quarter; all other spending earns 1% cashback with no limit. Here were the 2015 categories for illustration.

Chase Freedom is currently running a special promotion for the Holiday season. Beginning November 23, 2015, you can earn 10% cash back instead of 5% on those 4th quarter categories. The limit is the same $1,500 cash back during the promotional period.

Key Terms

- No Annual Fee

$100$150 (10,00015,000 Ultimate Rewards points) Sign Up Bonus after you spend $500 on purchases in your first 3 months from

account opening.- $25 (2500 Ultimate Rewards points) Bonus after you add your first authorized user and make a purchase within your first 3 months from account opening.

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate.

- Unlimited automatic 1% cash back on all other purchases.

- Cash Back rewards do not expire as long as your account is open.

- 0% Introductory APR for 15 months on purchases and balance transfers. Variable APR of 13.99% – 22.99% after intro period.

- Balance transfer fee is 3% of the amount transferred with a minimum of $5.

If you’re thinking of applying for this card, do it soon to take advantage of these limited-time opportunities.