Credit Card Travel Benefits: Worth More Than You Think!

Learning how to leverage your good credit score to obtain multi-benefit credit cards can be daunting, but when it comes to travel, this is where your hard work can really pay off. First-class family travel for free? Yes, it IS possible…here’s my recent example:

Learning how to leverage your good credit score to obtain multi-benefit credit cards can be daunting, but when it comes to travel, this is where your hard work can really pay off. First-class family travel for free? Yes, it IS possible…here’s my recent example:

Last month, my wife, my teenage daughter, and I took a trip to Phoenix for a few days of sun and fun in the desert–at almost NO COST. We also included a day trip to Sedona and the Grand Canyon, both places that we had never been to before. The flights and hotel were paid for using points. This kept the cash outlay for the trip limited to just meals, entertainment and car rental.

In addition to spending miles and points that were earned predominantly from credit cards, we also received additional travel-related benefits from those same credit cards. You might be surprised at how the value of those benefits adds up, even for a quick 5-day trip to Phoenix. I’ll tally it up for you at the end of this post.

Flights

For our outbound flight, we flew on American Airlines from New York’s LaGuardia Airport to Phoenix with a brief stop in Charlotte. Since I have a decent stockpile of American AAdvantage miles, I decided to splurge and book first class tickets for 25,000 miles each, or a total of 75,000 miles for the 3 of us. Those one-way tickets would have cost me $1,500 had I paid cash. One of my favorite benefits of the Citi AAdvantage Platinum Select credit card, which I currently hold, is the rebate of 10% of miles you redeem (up to 10,000). A few weeks after the trip, Citi deposited 7,500 miles back into my account. If I value those points at an extremely conservative 1.5 cents per point, that benefit alone was worth $112.50.

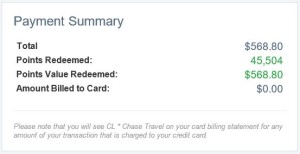

For our inbound flight, I found a fairly inexpensive one-way cash fare from Phoenix back to LGA with a stop in Denver on United Airlines. I ended up redeeming Chase Ultimate Rewards points at 1.25 cents per point to pay for the flight and we all earned United Miles as if we had paid cash. The three return fares cost me 45,500 Ultimate Rewards points.

For our inbound flight, I found a fairly inexpensive one-way cash fare from Phoenix back to LGA with a stop in Denver on United Airlines. I ended up redeeming Chase Ultimate Rewards points at 1.25 cents per point to pay for the flight and we all earned United Miles as if we had paid cash. The three return fares cost me 45,500 Ultimate Rewards points.

I also hold a Chase United MileagePlus Explorer credit card, which gave us the benefit of priority boarding on both connecting flights. With carry on luggage and a full flight, it was nice to have our choice of available overhead compartments for our bags.

Hotel

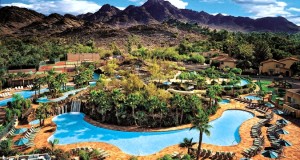

We stayed at the Pointe Hilton Squaw Peak, which was conveniently located and has great resort pools, complete with water slides and a lazy river. The standard rooms are suite style–perfect for families, with a bedroom for privacy and a foldout sofa for one or two kids. The early November room rate was $280 or 30,000 Hhonors points per night. I think anything approaching 1 cent per Hilton Hhonors point is pretty good, so I happily used points for the stay.

One of the many benefits of my American Express Platinum Card is Hilton Hhonors Gold elite level status. In turn, one of the benefits of Hilton elite status is a 5th night free for award stays of 5 nights. That saved me 30,000 points, valued in this case at $280. Another Hhonors Gold benefit is daily breakfast for 2 people per room. The Pointe Hilton Squaw Peak honored this benefit by giving us 2 x $10 hotel vouchers for each night of our stay. For 5 nights, that was a $100 that we could spend anywhere in the resort.

Car Rental

Another benefit of the American Express Platinum Card is Executive Status in National Car Rental‘s Emerald Club. We reserved and paid for a mid-size car and were able to choose any car parked in spots marked Executive. Cars are at least full-size and above. For this stay, I value that benefit at $20 for the upgrade.

I paid for the rental with my Chase Sapphire Preferred card. A lesser known benefit of this card is Primary car rental insurance. Many cards come with secondary insurance, which means they will cover any damage your personal auto policy doesn’t, like your deductible. With the Chase card’s primary coverage, if you need to make a claim, you can do it all through Chase. Your personal insurer will never know. There’s definitely value to this benefit, though it’s hard to quantify. I’d estimate it $20 for this trip.

Lounges

Before our departure from LaGuardia Airport, we visited the American Express Centurion Lounge. Entry is complementary for Platinum and Centurion cardholders and their family members or 2 guests. All food and beverages are also free. For this trip, I’d put the cash value this benefit at about $40, which is what I estimate we would have paid elsewhere for what we ate and drank. But you also need to consider the harder-to-quantify perk that comes with being “far from the maddening crowd”, especially when flying during peak vacation times. The benefit of having a clean, quiet, comfortable place to stretch out, have a few drinks, and relax before boarding a flight also has value.

In Denver, we had a layover of about 1.5 hours, so we passed the time in one of the United Clubs. I receive 2 free passes annually from my United Explorer Card. I was able to purchase a 3rd pass for my daughter from an auction on ebay for $15, so I’ll value the 2 free ones at $30.

Estimate Total Value of Benefits Received

Citi Aadvantage Platinum Card – $112.50

- 7,500 AAdvantage mile rebate: $112.50

Chase Sapphire Preferred – $20

- Primary Car Rental Insurance: $20

Chase MileagePlus Explorer Card – $30

- 2 United Club Passes: $30

- Priority boarding: peace of mind

American Express Platinum Card – $440

- Hilton Hhonors Gold 5th reward night free: $280

- Hilton Hhonors Gold breakfast credits: $100

- Centurion Lounge food and beverage: $40

- National Car Rental Upgrade: $20

The total value of credit card benefits I realized, just for this trip alone, was $602.50. For the American Express Platinum Card, I nearly covered its $450 annual fee. For the Citi AAdvantage Platinum Card, I realized more than its $95 annual fee in benefits.

The example above is my reason for this entire blog: to empower you with the knowledge of how to maintain a good credit score and how to choose the credit cards that are best suited to your needs. With the right information and careful planning, you too can save thousands on your travel costs AND do it in style.