Credit Cards

-

The Chase 5/24 Rule: When a Great Credit Score Isn’t Enough

You earn a good salary and your credit score is over 750, but Chase just denied your credit card application. How can this be? If you’ve opened 5 or more credit cards from any bank in the last 2 years, you just became the latest victim of the Chase 5/24 rule. Your good credit history is usually the most important prerequisite banks look for in order to approve you for a credit card. But with Chase’s unique credit card approval rule, your stellar credit takes a back seat to your potential profitability. Before applying for any Chase credit card, you’ll need to know what the Chase 5/24 rule is and if it applies to you. Here…

-

Rundown of all the New Amex Offers

Many new Amex Offers have been released over the last few days. If you have travel plans, the Sheraton Hotels and Ritz-Carlton deals are particularly lucrative and might influence your hotel choice. In addition, the 10% back on gas and tolls offers can provide you with a savings on money you’re probably spending anyway. For newcomers to these deals, check out my primer: Amex Offers = Too Good To Miss Out!. I wrote about how to connect your American Express card to your social media account and how to add offers to your card via Twitter, Facebook, or your americanexpress.com account. Twitter is the easiest method, but some offers are targeted, so you should be logging on to your…

-

More Negative Changes to Citi Prestige Coming

In an earlier post, I wrote about Citi’s plans to discontinue complimentary American Airlines Admirals Club lounge access for Prestige cardmembers. Unfortunately, that was only the beginning. More Citi Prestige changes have been announced and they’re all bad. In addition to the loss of Admirals Club access, Citi is reducing the value of ThankYou points redeemed for flights, discontinuing the Complimentary Golf benefit, and reducing the value (in some cases substantially) of the 4th Night Free hotel benefit. All these changes are to take effect July 23, 2017. Citi Prestige Changes Access to American Airlines Admirals Club lounges will no longer be offered. After July 23, 2017, current cardmembers will…

-

Citi Prestige Card to Discontinue AA Lounge Benefit

The Citi Prestige Card, one of Citi’s most expensive credit cards, is dropping a major benefit–complimentary access to American Airlines Admirals Club airport lounges. According to their website, Admiral’s Club access is due to expire on July 23, 2017. Citi Prestige has a $450 annual fee which is not waived the first year, so losing a benefit like this is certainly a blow. There’s no doubt that this is still a valuable card for travelers–particularly those that didn’t frequently use the lounge benefit. It remains to be seen how Citi will adjust other benefits or the annual fee to compensate cardmembers for the change. Card Benefits $250 Annual Air Travel Credit Each calendar year,…

-

Should I Cancel a Credit Card I No Longer Use?

There are times when it makes sense to cancel a credit card, but it’s oftentimes better not to. In “Before You Cancel That Credit Card, Read This!“, I wrote about the effects that canceling a card have on your credit score–it can never help, only hurt your score. In this article, I’ll go through some of the more common reasons I see given for wanting to cancel a card and discuss the validity of each reason. I have too much available credit This is a common misconception in consumer finance. Banks actually prefer if you have a large and varied amount of available credit. Risk is reduced by spreading it out…

-

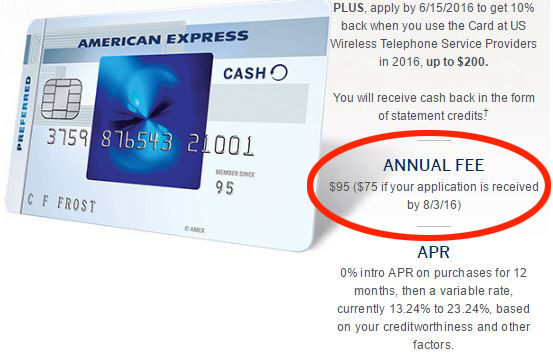

Amex Blue Cash Preferred Raising Annual Fee

Beginning August 3, 2016, the Annual Fee for the American Express Blue Cash Preferred credit card is increasing from $75 to $95. There’s been no announcement other than the notation on the web-based application. There is also no indication of any enhancement to the card’s benefits. The rest of this post is an update of Amex Blue Cash Everyday of Preferred. Which is Right For You? There are those who would never apply for a cash back credit card that charges an annual fee. Does it make sense to pay a fee to get your own cash back? The answer lies in your own spending habits and as you’ll see, those fees could…

-

United Credit Card Offering 50k-70k Bonus Miles

For a limited time, the Chase United MileagePlus Explorer card is offering an increased signup bonus. You can get 50,000 Bonus Miles after you spend $3,000 on purchases in the first 3 months your account is open. If your United MileagePlus account is targeted, that bonus might be 70,000 instead. This offer expires on June 30, 2016. The signup bonus is normally 30,000 miles after spending $1,000 in the first 3 months with the $95 annual fee waived for the first year. It’s important to note that with these limited time offers, the annual fee is not waived and will appear on your first statement. This product is not available to either (i)…

-

Chase Adds Flying Blue to Ultimate Rewards Partners

Chase has added a new partner to its Ultimate Rewards program. Effective immediately, you can now transfer your UR points to Flying Blue, the frequent flyer program of Air France and KLM. In addition to those airlines, Flying Blue miles can be redeemed for reward flights on SkyTeam Member Airlines like Delta, AlItalia, and AeroMexico. Flying Blue had already been a transfer partner of American Express Membership Rewards, Citi Thank You Rewards, and Starwood Preferred Guest. As with all of Chase’s other travel partners, UR points transfer to Flying Blue at a 1:1 ratio in increments of 1,000 points. FlyingBlue adds to the current list of Chase Ultimate Rewards airline partners:…

-

Which Credit Cards Pay For Global Entry or TSA PreCheck?

Long security lines at U.S. airports is commonplace during the summer travel season and this year should be no different. TSA Pre✓ gives trusted travelers the benefit of shorter lines and expedited screening. There is an application fee, but I’ll show you how to sign up for free. The U.S. Department of Homeland Security is encouraging travelers to sign up for TSA Pre✓ to help alleviate the delays: This is predicted to be one of the busiest air travel summers the airline industry has seen in a very long time and with more people flying, lines are expected to grow at TSA checkpoints. Travelers who are enrolled in TSA Pre✓or one…

-

Hot: Amex Personal Platinum Card 100k Bonus

UPDATE: This offer is no longer available. Thanks to ChetHazelEyes over at Reddit Churning for the alert about this fantastic offer. Apply now for the Personal Platinum Card from American Express and get 100,000 Membership Rewards points after spending $3000 with the card in the first 3 months. This offer is not available to applicants who have or have had this product in the past. The link to this offer can be found here. It takes you to the landing page with all the offer terms spelled out. Note that, as usual, the $450 annual fee is not waived the first year. Main Platinum Card Benefits I consider the Platinum Card to be…