-

Chase Adds Flying Blue to Ultimate Rewards Partners

Chase has added a new partner to its Ultimate Rewards program. Effective immediately, you can now transfer your UR points to Flying Blue, the frequent flyer program of Air France and KLM. In addition to those airlines, Flying Blue miles can be redeemed for reward flights on SkyTeam Member Airlines like Delta, AlItalia, and AeroMexico. Flying Blue had already been a transfer partner of American Express Membership Rewards, Citi Thank You Rewards, and Starwood Preferred Guest. As with all of Chase’s other travel partners, UR points transfer to Flying Blue at a 1:1 ratio in increments of 1,000 points. FlyingBlue adds to the current list of Chase Ultimate Rewards airline partners:…

-

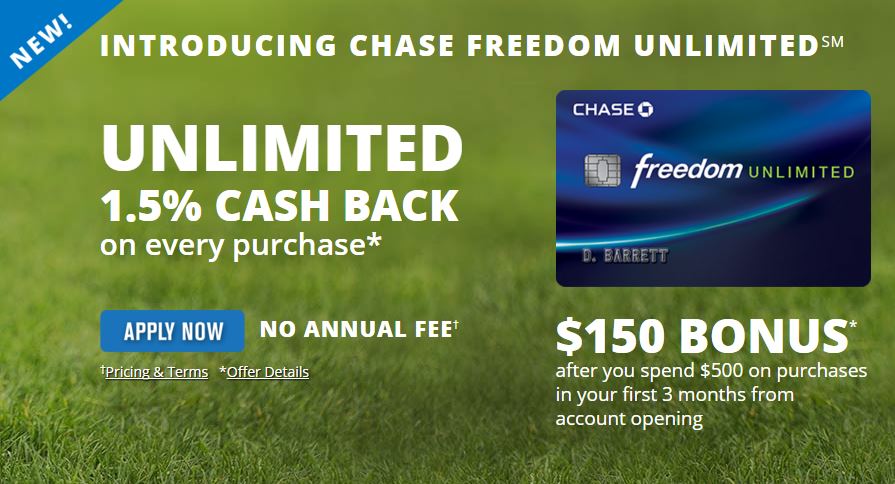

New Freedom Unlimited Credit Card from Chase

Chase has added another credit card to its Ultimate Rewards arsenal. The new Freedom Unlimited, unlike its sibling, has no category bonuses or quarterly activations. You earn 1.5 points on every dollar you spend–unlimited. Freedom Unlimited is a great complement to Chase’s other Ultimate Rewards earning cards. Continue to use the other cards to spend in bonus categories. Freedom Unlimited is now the card to use for “everything else.” Card Details 15,000 ($150) bonus points after you spend $500 on purchases in your first 3 months 2,500 ($25) bonus points when you add your first authorized user and make your first purchase in your first 3 months 1.5x Ultimate Rewards points on all…

-

Should You Pay the Annual Fee for the Chase Sapphire Preferred?

Chase Sapphire Preferred (CSP) provides a number of additional benefits that the Chase Freedom card doesn’t offer. However, those extras come at a cost. After being waived the first year, the annual fee of $95 will kick in. Is it worth paying? I’ll walk you through the extra benefits and do the math for you with a calculator at the end of this article. The premise behind this exercise is that you are deciding whether to keep your CSP and pay the annual fee or downgrade it to a Freedom card to save the $95 (or simply cancel if you already have a Freedom). To make this determination, my calculator requires only 4 variables:…

-

Get a Credit Card Signup Bonus with your Next Big Purchase

Do you have a fairly large purchase requirement on the horizon? Consider applying for a new credit card that offers a generous signup bonus on which you can charge the purchase to soften the blow. If you have excellent credit and don’t plan on shopping for any loans in the next few months, then this might be exactly the right time! The most lucrative benefit a credit card typically offers is its signup bonus. For many consumers, however, the biggest hurdle to earning the bonus is meeting the minimum spend requirement. But if you’re about to buy some new furniture, jewelry or appliance, or you just NEED to have that 70″ flat screen 4k Ultra HD…

-

Do Credit Card Points Expire? Not if You’re Careful

You’ve earned all those credit card rewards points from spending and sign up bonuses, it would be a shame to lose them. The good news is that these points typically don’t expire, but if you’re not careful, you can accidentally forfeit them. Read on to make sure that doesn’t happen. Cash back credit cards are consistent and fairly straightforward: your cash-back credits won’t expire as long as your account is open. If your card has no annual fee, there’s no reason to cancel it… Ever! There is no downside to keeping a free credit card account active–even if you rarely use it–and it will help your credit score at the same…

-

How to Transfer Chase Ultimate Rewards to Travel Partners

Do you want to get the best value from your Chase Ultimate Rewards points? As I wrote in Chase Sapphire Preferred 50k Bonus Points – How to Use Them Best, the greatest value can be realized when you transfer them to airline frequent flier and hotel loyalty accounts. This step-by-step guide will walk you through the process. Introduction The Ultimate Rewards travel transfer option that I’ll be explaining is only available if you have a Sapphire Preferred , Sapphire Reserve, or Ink Plus business card. If you only hold a Chase Freedom, Freedom Unlimited or Ink Cash card, you’ll need to add a premium card to your wallet in order to take advantage of…

-

Credit Card Travel Benefits: Worth More Than You Think!

Learning how to leverage your good credit score to obtain multi-benefit credit cards can be daunting, but when it comes to travel, this is where your hard work can really pay off. First-class family travel for free? Yes, it IS possible…here’s my recent example: Last month, my wife, my teenage daughter, and I took a trip to Phoenix for a few days of sun and fun in the desert–at almost NO COST. We also included a day trip to Sedona and the Grand Canyon, both places that we had never been to before. The flights and hotel were paid for using points. This kept the cash outlay for the trip limited to…

-

Chase Sapphire Preferred 50k Bonus Points – How to Use Them Best

For a limited time, Chase Sapphire Preferred is offering an increased sign up bonus of 50,000 Ultimate Rewards points (normally 40,000) after spending $4,000, PLUS another 5,000 points when you add an authorized user and make a purchase. This makes one of Chase’s most popular travel rewards cards even more valuable–if you use the points wisely. Before you even consider applying for this card, it’s important to note that Chase has been denying applications if you’ve had more than 5 new credit cards appear on your credit report in the last 24 months–regardless of your credit score. If someone has added you as an authorized user on their card, that…

-

Chase Freedom Ultimate Rewards vs Sapphire Preferred Ultimate Rewards: Know Your Points!

When it comes to getting the most out of your Ultimate Rewards points, it’s essential to know which points you have, so that you can determine if you’re redeeming them for the highest possible value. I’ll explain the differences to make sure you’re not leaving money on the table. Chase has two flagship credit cards: Freedom and Sapphire Preferred. Every dollar you charge to these two cards earns you points in the Ultimate Rewards program. While each card shares the “Ultimate Rewards” name, there are important differences in how you can redeem your points. Chase Freedom Ultimate Rewards There 6 ways you can use the Ultimate Rewards (UR) points that…

RECENT POSTS