-

New Uber Visa Credit Card Coming Next Week

UPDATE: Application Link is now live. On November 2, BarclayCard will launch their new Uber Visa credit card with a $100 signup bonus and up to 4% cash back with no annual fee. You can use the points earned with this card for Uber credits, gift cards, or statement credits. The Uber Visa credit card’s benefits were designed with Uber customers in mind. Card holders will earn 4% cash back on dining, 3% on hotel and airfare, 2% on Uber rides and online purchases and 1% back on all other spending. You can also get up to a $50 credit for online subscription services such as Netflix and Spotify after you…

-

Increased Signup Bonus for Capital One Venture

Capital One is rolling out an increased bonus offer for its Venture travel rewards credit card. You can now earn 50,000 bonus miles (increased from 40,000) after you spend $3,000 on purchases in the first 3 months. Depending on which online link you use, the annual fee is $59 or $95 but waived the first year. Link to $59 annual fee AND 50,000 mile bonus What are Reward “Miles”? Although Capital One uses the word “miles” to describe the rewards that you earn when you spend using this card, Venture is more like a cash back card. Each “mile” is worth 1 cent towards travel purchases charged to the card. This…

-

New 50k Bonus Offer for United MileagePlus Club Card

For a limited time, Chase and United are offering a 50,000 mile welcome bonus for the MileagePlus Club card. This premium card has a $450 annual fee (not waived the first year) but comes with a United Club airport lounge membership (normally $550/year). Keep in mind, this card is subject to Chase’s 5/24 approval rule. The public application link can be found here. I’ve seen various welcome offers for this card in the past: $100 bonus after first purchase, waived first year annual fee, and bonus MileagePlus miles. This is simply the latest bonus flavor. If you’re a frequent flyer thinking about a United Club membership and covet MileagePlus miles,…

-

Extra Points by Using Chase Sapphire Card and Digital Wallet

From now through November 4, 2017, some Chase credit cards will earn an extra point if you pay using a digital wallet. Just use your Chase Sapphire, Sapphire Preferred, or Sapphire Reserve in Android Pay, Apple Pay, Samsung Pay or Chase Pay. You’ll earn 1 additional Ultimate Rewards point per $1 spent–up to $1,500 during the promotional period. This is a simple way to earn extra points on everyday purchases. By using your Sapphire card and digital wallet, you’ll earn at least 2x UR points on all spending and up to 4x UR points on travel & dining if you have the Sapphire Reserve. It’s completely automatic–there’s nothing you need…

-

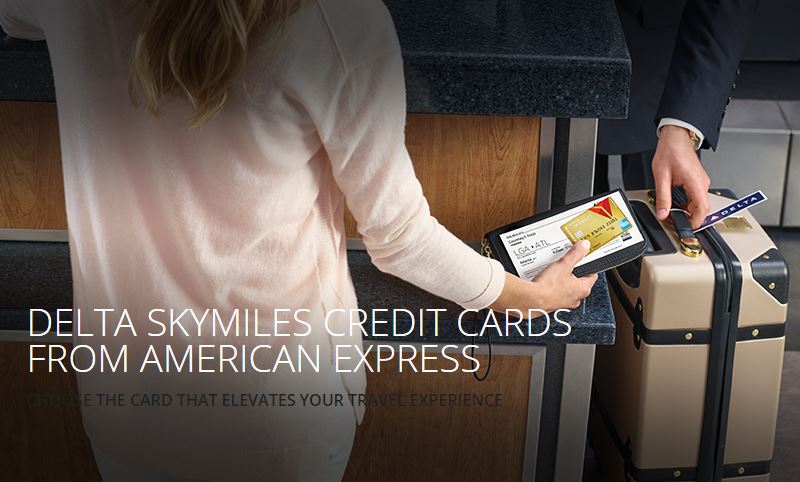

Increased Amex Welcome Bonuses: Up to 70000 Delta Skymiles

For a limited time, Delta and American Express are offering increased welcome bonuses on their Gold and Platinum SkyMiles credit cards. This news comes shortly after Amex launched a new no-annual-fee Delta card. You can earn 70,000 bonus SkyMiles with the Platinum Delta card and 60,000 SkyMiles with the Gold. Act fast as these increased offers are set to expire on November 8, 2017. Using SkyMiles can sometimes be hit or miss, but one-way award flights start at only 5,000 miles. This summer, I flew my family of 5 round trip between LGA and CHS for a total of 50,000 SkyMiles. That saved me about $1,000, valuing the redemption at…

-

Chase Announces 4th Quarter Bonus Categories for Freedom Card

The Chase Freedom credit card earns 5% cash back in bonus categories that change each quarter. The categories for the 4th quarter of 2017 have just been announced. Earn 5% cash back on up to $1,500 in combined purchases from October 1 – December 31, 2017 at Walmart and Department Stores. The “Walmart” category does not include merchants operating within or on Walmart premises such as merchants that sell fast food, beauty services, and gas stations that are not Walmart branded. Walmart affiliate businesses such as Sam’s Club are excluded and will not earn bonus rewards. Online purchases at walmart.com are included. The Department Store category does not include supercenters, discount stores or…

-

Make Sense of Your Free Credit Scores

Is your shirt size medium or large? How about your dress size? Or your shoe size? Very often, your size depends on what store you’re shopping in. Believe it or not, the same goes for your credit scores. They’re different depending on where you get them from. I’ll show you how to make sense of your free credit scores, how they’re calculated, and which ones are more meaningful than others. What is a Credit Score? Your credit score is a 3 digit number that represents your creditworthiness to lenders. The higher the number, the more creditworthy you are. This score is derived from all of the data that’s in your…

-

Priority Pass Restaurants

Note: This post is updated regularly to include new restaurant additions UPDATE: American Express has eliminated Priority Pass restaurant credits on its credit cards effective 8/1/19. In an effort to increase its offerings, Priority Pass has added restaurants to its list of airport lounges. When dining at these participating venues, simply order off the menu as you normally would and Priority Pass will provide you and your guests with a credit toward your meal. A current list of participating restaurants follows at the end of this article. Credits are typically $28 per person depending on the restaurant. You are responsible for gratuity. Simply present your Priority Pass card before placing an order…

-

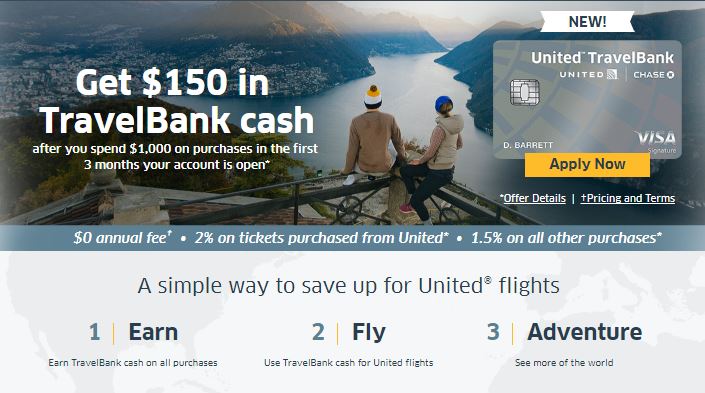

New Chase United TravelBank Credit Card

Chase and United Airlines have launched a new credit card, the Chase United TravelBank Card. Unlike traditional airline credit cards that earn frequent flyer miles, this no-annual-fee card earns United TravelBank cash that can be redeemed toward the purchase of a United ticket. This hybrid cash back/travel rewards card won’t attract savvy points & miles junkies, but it might appeal to the casual United flyer. The Chase United TravelBank card does not offer perks that you see with other premium travel cards such as free checked bags, priority boarding or airport lounge access. The only travel-day benefit is a 25% discount on food and beverage purchases onboard. New cardholders will earn a signup…

-

Amex Launches New Delta No Annual Fee Credit Card

Today, American Express and Delta launched the new Blue Delta SkyMiles credit card. The new card earns miles in the Delta SkyMiles program and carries no annual fee. In addition, you can earn 10,000 Bonus Miles after spending $500 in purchases on your new Card in your first 3 months of Card Membership. The Offer Terms include some new language that I haven’t seen before from American Express. The new language is in bold: Welcome bonus offer not available to applicants who: • Have or have had this product or the Delta SkyMiles® Options Credit Card, or • Currently have or have had one of the following products in the last…

FEATURED POSTS

RECENT POSTS