The Real Value of Good Credit

We’ve all seen the television commercials about the importance of knowing one’s credit score. But how much is good credit actually worth? The answer may surprise you.

We’ve all seen the television commercials about the importance of knowing one’s credit score. But how much is good credit actually worth? The answer may surprise you.

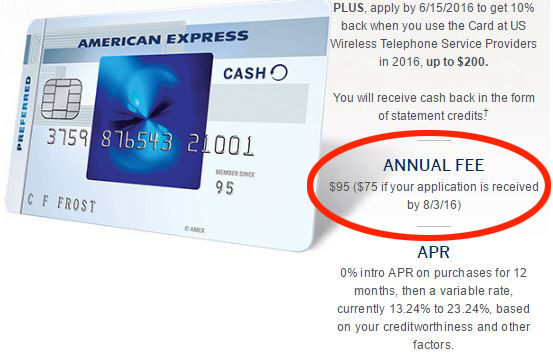

A low credit score is symptomatic of poor financial habits–habits that can cost you BIG TIME, in addition to any exorbitant interest you may be paying on your monthly credit card bills. How much more could it cost? Let’s say you’re buying a $200,000 house with a 20% down payment. On a 30 year $160,000 mortgage, having a credit score of 650 instead of 750 can cost you nearly $35,000 in additional interest payments over the life of the loan.

Check your Credit Report for free

The first step to a better credit score is knowing what’s in your credit report. There are three companies that report on your credit: Equifax, Experian, and Transunion. According to this article on the Federal Trade Commission’s website…

“The Fair Credit Reporting Act (FCRA) requires each of the nationwide credit reporting companies — Equifax, Experian, and TransUnion — to provide you with a free copy of your credit report, at your request, once every 12 months.“

A good habit would be to stagger requests across all 3 agencies to obtain a new report every 4 months. You are also entitled to request a free report if you’ve been denied credit, insurance, or employment in the last 60 days.

What’s in These Reports?

Your credit report will contain your current and any prior residential addresses as well as your employment history. The report also includes all (both open and closed)

- Credit Card Accounts

- Student Loans

- Auto Loans and Leases

- Mortgages

For all these accounts, a detailed payment history will be shown. There will also be a section listing any recent credit inquiries (credit, loans or insurance you’ve applied for in the last 2 years).

Checking your credit report frequently for errors will help protect you against identity theft and fraud. Refer to this FTC article on disputing credit reports if you see any errors. Visit annualcreditreport.com for more information on obtaining your free reports.

What about Credit Scores?

The official credit scores used by credit issuing banks are calculated by FICO (Fair Isaac & Company). You might notice that I just referred to “Credit Scores” in plural. You actually have 3 official FICO scores. Each one based on data from the 3 credit reporting agencies. They can, and most likely will, be slightly different. I’ll go into why that is the case in future posts.

While the credit reporting agencies will provide annual free reports as required by statute, getting your scores directly from them will cost you. If you want all 3 official scores, myFICO is your best source, but it doesn’t come cheap.

The good news is there are other ways to obtain a fairly good approximation of your credit score for free. CreditKarma, CreditSesame, Quizzle, and WalletHub provide you with a score provided by a VantageScore model—not FICO. Quite frankly, having a good handle on the accuracy of your credit reports and a rough estimate of your credit score using these free sites is enough for most if not all circumstances.

In upcoming posts, I’ll discuss how your scores are computed in more detail as well as how to improve them.