7 Keys to Higher Credit Scores

It’s always a good time of year to review some basic steps to achieving higher credit scores. Here are 7 keys to getting instant approvals on those rewards credit cards or the lowest possible rate on your mortgage.

Be Disciplined

As is the case with most personal finance strategies, being disciplined is the key. The good news: thanks to the advent of technology, it’s much easier now than in the past to be disciplined in building your credit. If you fully commit yourself to the process of boosting your credit rating, higher scores–and the multitude of benefits and special offers that come with them–can be yours.

Auto Pay Is Your Friend

The first step is to set up an online account and enroll in auto-pay for every recurring payment you have. Your mortgage, credit card statements, cell phone and cable bills, etc. can all likely be paid this way. If not, then use the free online banking auto-pay that comes with your checking account. The ultimate goal is to never miss a payment, because that’s the largest driver of your credit score.

Rewrite History

You can’t change your past history, but taking the steps above should help ensure that your future payments are all on time. The one blemish on my own credit report is from a missed gas station credit card payment from a few years ago. That was when I was still getting paper statements via snail mail and it accidentally got tossed out in the trash. It happens.

If you do miss a payment, don’t panic. Pay it as soon as possible and call your lender. Oftentimes, as a service to good customers, they can waive any late fees and not report your payment as “late” to the credit bureaus. It’s certainly worth a try.

Keep Your Balances Low

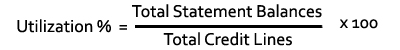

This is the other big factor in your credit score. This is where, depending on how you manage your credit, you can make a huge impact on your score in a few short months. I prefer to call this category “Credit Utilization” as it is a function of how you use your available credit. Here’s a simple formula you can use to figure out your Utilization percentage:

If you “max out” your credit cards every month, then your credit utilization is 100%. That’s very bad for your score. If you have credit cards but never use them at all, then your utilization is 0%. That, surprisingly, isn’t very good for your score either. Lenders want to see that you’re actually using your credit, but doing it wisely. Credit utilization between 1% and 20% is ideal. If you really want the highest FICO score you can possibly get, keep your utilization between 1% and 5% every month.

If you are in a financial position where you are paying your credit card bills in full each month, here’s a great strategy to follow: the major credit card companies report your total current balance (not your individual transactions) to the credit bureaus typically once each month, at the same time your statement hits. So here’s the trick: pay down your credit card balance to NEAR ZERO a couple days BEFORE your statement date. You may have run up a big balance during the month, but the reporting bureaus will never know. All they’ll see is a low utilization percentage, because you already paid it down.

Age Gracefully

Age Gracefully

Your credit report will list the date when each of your credit accounts was established. Having old accounts is better than having only all new accounts. Who knew debt was like fine wine?

On your report you may see some old retail store or major credit card accounts that you nearly forgot you had. If there’s no annual fee, there’s no harm in keeping it open since it helps with the average age of your accounts. It also boosts your “Total Credit Lines” in the formula above.

If you’re just starting out, looking for your first credit card to apply for, it’s best to focus on those with no annual fee. Whatever you get approved for, you’ll want to keep it for as long as you can to help build your score.

You Don’t Need EVERY Credit Card

While new credit inquires (hard pulls) have less of an impact than the factors above, this is still a component you should think about AND have a strategy for. At first, applying for 2 or 3 credit cards in a year should be fine. As you build a better credit profile, you can apply with more frequency without having a negative impact.

Knowing which credit bureau a particular bank pulls from is quite helpful. As you get more aggressive in leveraging credit card sign-up bonuses in order take advantage of deals and offers, this will enable you to balance out the inquiries across all three bureaus.

Most importantly, if you’re planning on shopping for a mortgage soon, then put the brakes on applying for any other type of credit until you are approved. You don’t want to do anything that might jeopardize your ability to get the best possible rate from your mortgage lender.

Credit Mix: Should You Diversify?

The short answer: don’t worry about it too much. In addition to being the category that has the least overall impact on your credit score, your credit mix is, in my opinion, also the least manageable. It’s true that your credit score will be higher if you have availed yourself of different types of debt, because it indicates that a good mix of lenders has approved you for credit. However, don’t run out and buy a condo, just so you can have a mortgage to improve your credit mix. The other strategies laid out above will have a more positive impact, with far less effort.