Rethinking My American Express Platinum Card

I’ve held some version of the Platinum Card from American Express for longer than I’d care to share. I have been consistently getting much more value in benefits than what I paid in annual fees. Now, I’m not so sure.

Cost

Lets start with the cost. For the last 3 years, I’ve paid no annual fees for the card. I’ve been cycling through the Ameriprise version which waived annual fees for the first year. That included up to 3 additional cardholders, which I took advantage of. Achieving value is easy when the cost is $0.

Prior to that, I had a regular Platinum card but, due to some glitch, I was not being charged for my additional cardholders. That reduced the cost by $175 per year.

This year, the jig is up. In a surprise to no one, Ameriprise no longer offers a version of the card with the first year free. Come December or January, I’ll be charged the $550 annual fee plus $175 for the 3 additional cards for my family members. That’s a cost of $725 that I need to justify.

Benefits

Airline Incidental Fee Credit

The biggest benefit to me has been the $200 airline incidental fee credit. While this benefit is intended to offset fees (baggage, seat selection, etc), and not airfares, a well-known workaround has been to purchase airline gift cards. They would trigger the credit and you could use them to purchase flights. In the last few months, this loophole has been closed.

I rarely–if ever–incur the airline fees that this credit is intended to cover. Without the gift card workaround, the value of this benefit drops to near zero for me. That’s a huge loss.

Lounge Access

The next benefit I’ve enjoyed has been lounge access. My home airport is LGA which has a Centurion Lounge. I often fly Delta and when I do, I use their Sky Clubs. I’ll be flying on AA out of PHL soon and I’m looking forward to trying that Centurion Lounge for the first time.

There’s also the Priority Pass membership, but that benefit will be cut back by Amex next month. I have a Chase Sapphire Reserve, which also has a Priority Pass membership, making this particular benefit redundant.

Lounge access is difficult to quantify since it’s a “nice to have”, but certainly not a “need to have” benefit.

Uber Credits

This $200 credit is broken down by month–$15 each month, $35 in December. I use Uber only on occasion. The fact that it’s broken down by month (rather than a simple $200 annual credit) is annoying. I probably realize about $30 per year.

Saks Fifth Avenue Credit

This $100 credit is split: $50 for the first half of the year and another $50 for the second half. Have I used this credit? Sure. Do I really need the stuff I’m buying for about $50 every 6 months? No, not really. I have no reason to be shopping at Saks aside from this credit.

Global Entry/TSA Pre-Check Credit

This credit is a $100 reimbursement available every 4 years. In the past year, I’ve renewed my (and my family members’) Global Entry and made full use of the credits. That said, I won’t need it again until 2024, and I have one credit available via my Chase Sapphire Reserve. I won’t miss this benefit any time soon if I cancel my Platinum Card.

Other Benefits

5x Membership Rewards Points on airfare and hotels is nice, but I never take advantage of it. The travel insurance provided by Amex is so inferior to that of Chase, that I’m always happy to settle for 3x Ultimate Rewards points instead.

I find Marriott Gold Elite status fairly worthless. Hilton Gold Elite status has some value, but I think I can status match my way to Hilton Gold without the Platinum Card. Similarly, I can status match my way to elite status with Hertz and National Car Rental.

I’ve never found much use for the Platinum Concierge. I called them once for concert tickets and was quoted a ticket broker’s price which I could have easily done myself.

Finally, Fine Hotels & Resorts doesn’t fit my travel habits. Even if it did, I can use a Virtuoso travel agent and get most of the same benefits without needing a Platinum Card.

Bottom Line

I’m not going to sugarcoat it: It’s clear that I’ve gotten a huge amount of benefits the past few years from my Platinum Card(s) while paying nothing in annual fees. Thanks, Amex and Ameriprise. That being said, I prefer to look forward rather than backward.

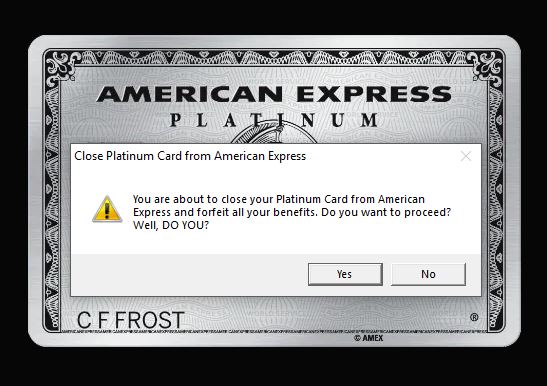

So here I am. In a few short months, I’ll be faced with a $725 decision. It would be difficult to justify that cost even if the airline gift card workaround was still in play. Without that, I don’t see keeping the card as an option.

In the past when I’ve called to cancel, I’ve been offered some amount of cash or Membership Rewards points as a retention bonus. I’ve always declined the offer since the prospect of getting another free year out of a new Ameriprise card was always worth more. But that option no longer exists.

I imagine I’ll be offered some retention bonus again this time when I call. There are recent data points of $500 or 50k MR points being offered. That would keep me for another year.

Another scenario is to look for a 75k or possibly 100k MR signup bonus for my wife and have her apply. She can add me as an additional cardholder and we’ll basically be in the same place–except with the bonus points.

I still have some time to think about it, but it’s pretty clear. The value of the Platinum Card, without a substantial signup or retention bonus, is just not there for me any longer.