-

Increased Signup Bonuses for Hilton Credit Cards

A few weeks ago, I wrote about the merits of the various Hilton branded credit cards. That article also describes the Hilton HHonors points program and its benefits, as well as links to each hotel broken down by reward level. Since then, limited time increased signup bonuses are now available for three of the four cards. Here are the new offers and links to get the better bonuses. These are not referral links–I am not compensated in any way when you click through. Citi Hilton HHonors Visa Signature Card Regular Bonus: 40,000 HHonors Points after spending $1,000 in the first 4 months. New Bonus: 75,000 HHonors Points after spending $2,000 in the first…

-

Time to Plan Some Late Summer Home Improvement Projects with Discover It Card

The Discover It card’s 5% Cashback Bonus categories for the remainder of 2016 were recently announced, and July through September looks compelling. Use your Discover It card at home improvement stores like Lowe’s and Home Depot in the 3rd Quarter and get 5% cashback on up to $1,500 in purchases. If you’re planning some projects now, it might be worth putting them off until July to capitalize on the bonus–wish me luck explaining that to Mrs. PointsYak. All the 2016 bonus categories are listed in the graphic below. Amazon.com is prominently featured in the entire second half of the year, while “& More” in the 4th Quarter is vague at best.…

-

Get a Credit Card Signup Bonus with your Next Big Purchase

Do you have a fairly large purchase requirement on the horizon? Consider applying for a new credit card that offers a generous signup bonus on which you can charge the purchase to soften the blow. If you have excellent credit and don’t plan on shopping for any loans in the next few months, then this might be exactly the right time! The most lucrative benefit a credit card typically offers is its signup bonus. For many consumers, however, the biggest hurdle to earning the bonus is meeting the minimum spend requirement. But if you’re about to buy some new furniture, jewelry or appliance, or you just NEED to have that 70″ flat screen 4k Ultra HD…

-

Valentine’s Day Offers from American Express

Everywhere I look, I am reminded that Valentine’s Day is quickly approaching–even when I log on to my americanexpress.com account. Prominently listed are the latest Amex Offers from Teleflora, 1-800 Flowers and FTD as well as Shari’s Berries and AmexTravel. Lets have a look at those deals, as well as a recap of all the public offers currently available via Twitter. Amex Offers Background The Amex Offers program is one of my favorite credit card perks that everyone with an American Express card should be taking advantage of. In fact, it is reason enough to have at least one, if not multiple American Express Cards in your wallet. For newcomers to these deals, check…

-

My Latest Credit Card Retention Call

It’s been a year since I was approved for my Chase United MileagePlus Explorer credit card. At the time, my account was targeted for 50,000 MileagePlus Miles after spending $3,000 in addition to the usual no annual fee for the first year. I was able to take advantage of that offer AND get a $50 statement credit for applying while booking a flight on United’s website. I never did complete the flight booking, I just wanted the $50 credit! This morning, I noticed that the $95 annual fee charge for the card appeared in my account, so it may be time to cancel. It’s not uncommon for credit card issuers…

-

Which Credit Card Should You Get if you Stay at Hilton Hotels

There are well over 4000 Hilton hotels and resorts worldwide, across brands ranging from luxurious (Waldorf Astoria) to moderately priced (Hampton Hotels). With such a large global footprint, travelers will often find a Hilton property to be a convenient and comfortable choice for their lodging. The Hilton HHonors program rewards loyal guests with benefits and the ability to earn points that can be redeemed for free nights and, like most loyalty programs, there’s no cost to sign up. You can also earn HHonors points and elite status from certain affiliated credit cards. We’ll go through the benefits of each one, so you can find the card (or combination of cards) that best…

-

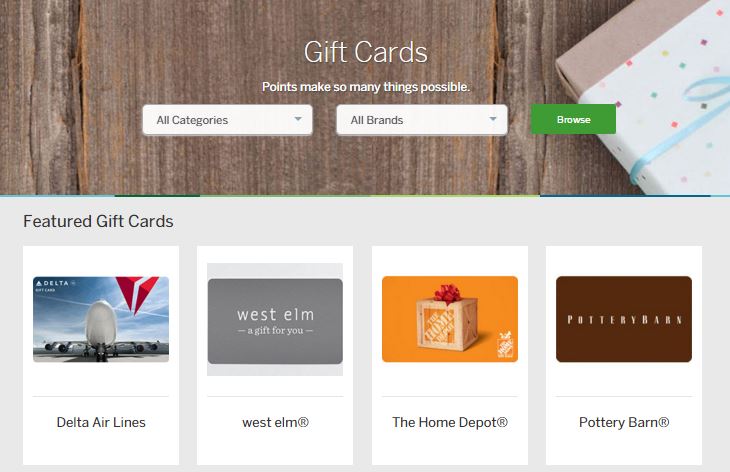

What to do with Membership Rewards Points if you Don’t Travel

The best way to achieve the greatest value for your American Express Membership Rewards points is by transferring them to Airline and Hotel travel partner programs. That’s where you can often get more than 1.5 cents per point on flights and rooms, sometimes WAY more. But if you don’t travel, should you shun the American Express cards that earn these points? Not necessarily, as there are other redemption options. Be careful when you redeem your points, as each method gives you different a value for your points–some are downright awful. I’ll go through each one in the order of “Least desirable-don’t do it!” to “Best method in a pinch.” Shopping on Americanexpress.com A prominently…

-

Before You Cancel That Credit Card, Read This!

One question that I am asked frequently is: “Will it help or hurt my credit score if I cancel a credit card?” I can say with certainty that the singular act of cancelling a card will never help your score. And, depending on your credit profile, the negative impact could range from negligible to significant. In my article “Decoding Credit Score Mystery Math“, I explained the factors that make up your score. The three largest factors are: Payment History (35%), Credit Utilization (30%), and Average Age of Accounts (15%). Let’s have a look at how canceling a credit card impacts these factors. Payment History Some readers may feel that closing a credit card where they have…

-

Do Credit Card Points Expire? Not if You’re Careful

You’ve earned all those credit card rewards points from spending and sign up bonuses, it would be a shame to lose them. The good news is that these points typically don’t expire, but if you’re not careful, you can accidentally forfeit them. Read on to make sure that doesn’t happen. Cash back credit cards are consistent and fairly straightforward: your cash-back credits won’t expire as long as your account is open. If your card has no annual fee, there’s no reason to cancel it… Ever! There is no downside to keeping a free credit card account active–even if you rarely use it–and it will help your credit score at the same…

-

A Handy Tool For Using the Right Credit Card for Every Purchase

You’re standing in line at the grocery or office supply store, holding a wallet overflowing with credit cards, and you can’t remember which one you should use to get the most cash back. Sound familiar? Same here, and that’s exactly why I created the PointsYak Cashback Lookup Tool: just follow the link, bookmark it on your mobile phone, and finding the right cashback card for every purchase will always be just a click away! There’s no app to download, no GPS tracking your whereabouts, and no sign-up required. Shopping online is usually the best the way to maximize your savings, and my last article, “Maximize Cashback and Points Using Online Shopping Portals”, showed you how…

RECENT POSTS