-

Extra Points by Using Chase Sapphire Card and Digital Wallet

From now through November 4, 2017, some Chase credit cards will earn an extra point if you pay using a digital wallet. Just use your Chase Sapphire, Sapphire Preferred, or Sapphire Reserve in Android Pay, Apple Pay, Samsung Pay or Chase Pay. You’ll earn 1 additional Ultimate Rewards point per $1 spent–up to $1,500 during the promotional period. This is a simple way to earn extra points on everyday purchases. By using your Sapphire card and digital wallet, you’ll earn at least 2x UR points on all spending and up to 4x UR points on travel & dining if you have the Sapphire Reserve. It’s completely automatic–there’s nothing you need…

-

Chase Limits New Sapphire Card Signups

One year after launching the incredibly popular Sapphire Reserve card, Chase has placed new restrictions on eligibility for new Sapphire Credit Card products (Sapphire Reserve, Sapphire Preferred, and Sapphire). If you currently have any one of those 3 cards OR if you’ve received a signup bonus from ANY of those cards in the last 24 months, you will not be approved for a new Sapphire product. Here’s the language directly from chase.com: This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 24 months. If you are an existing Sapphire customer and would…

-

Should You Cancel Sapphire Preferred after getting the Reserve Card?

Congratulations! You’ve been approved for the extremely popular Chase Sapphire Reserve credit card! Now what should you do with the your other Ultimate Rewards earning cards like Freedom and Freedom Unlimited? Should you cancel Sapphire Preferred? The answer is different for each card. There’s no reason to cancel the cards that don’t charge an annual fee, but Sapphire Preferred does and also shares many of the same benefits as Sapphire Reserve. I’ll go through each card and explain what your options are. Background Having additional Chase credit cards that earn Ultimate Rewards is a great complement to the Sapphire Reserve. You can earn points by purchasing goods and services with one card, then…

-

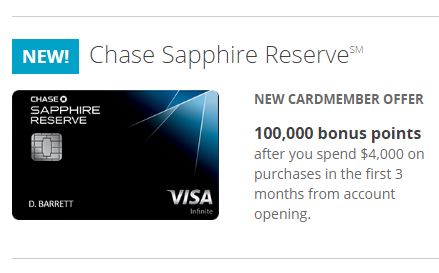

The New Chase Sapphire Reserve Card Looks Fantastic!

UPDATE: The 100,000 point signup bonus offer for online applications will be reduced to 50,000 on January 12, 2017. Chase has introduced its new premium travel credit card, Sapphire Reserve, and it looks fantastic! Loaded with benefits, it carries a hefty $450 annual fee. This new addition to its lineup finally gives Chase a direct competitor to The Platinum Card from American Express and Citi Prestige. Sapphire Reserve offers a myriad of travel benefits that more than make up for the annual fee, including an annual $300 travel credit, complimentary Priority Pass airport lounge access, and Global Entry/TSA Pre✓ credit. Unfortunately, this card is subject to Chase’s restrictive 5/24 rule. Last week, I wrote…

-

More Negative Changes to Citi Prestige Coming

In an earlier post, I wrote about Citi’s plans to discontinue complimentary American Airlines Admirals Club lounge access for Prestige cardmembers. Unfortunately, that was only the beginning. More Citi Prestige changes have been announced and they’re all bad. In addition to the loss of Admirals Club access, Citi is reducing the value of ThankYou points redeemed for flights, discontinuing the Complimentary Golf benefit, and reducing the value (in some cases substantially) of the 4th Night Free hotel benefit. All these changes are to take effect July 23, 2017. Citi Prestige Changes Access to American Airlines Admirals Club lounges will no longer be offered. After July 23, 2017, current cardmembers will…

-

Should You Pay the Annual Fee for the Chase Sapphire Preferred?

Chase Sapphire Preferred (CSP) provides a number of additional benefits that the Chase Freedom card doesn’t offer. However, those extras come at a cost. After being waived the first year, the annual fee of $95 will kick in. Is it worth paying? I’ll walk you through the extra benefits and do the math for you with a calculator at the end of this article. The premise behind this exercise is that you are deciding whether to keep your CSP and pay the annual fee or downgrade it to a Freedom card to save the $95 (or simply cancel if you already have a Freedom). To make this determination, my calculator requires only 4 variables:…

-

Get a Credit Card Signup Bonus with your Next Big Purchase

Do you have a fairly large purchase requirement on the horizon? Consider applying for a new credit card that offers a generous signup bonus on which you can charge the purchase to soften the blow. If you have excellent credit and don’t plan on shopping for any loans in the next few months, then this might be exactly the right time! The most lucrative benefit a credit card typically offers is its signup bonus. For many consumers, however, the biggest hurdle to earning the bonus is meeting the minimum spend requirement. But if you’re about to buy some new furniture, jewelry or appliance, or you just NEED to have that 70″ flat screen 4k Ultra HD…

-

Chase Sapphire Preferred 50k Bonus Points – How to Use Them Best

For a limited time, Chase Sapphire Preferred is offering an increased sign up bonus of 50,000 Ultimate Rewards points (normally 40,000) after spending $4,000, PLUS another 5,000 points when you add an authorized user and make a purchase. This makes one of Chase’s most popular travel rewards cards even more valuable–if you use the points wisely. Before you even consider applying for this card, it’s important to note that Chase has been denying applications if you’ve had more than 5 new credit cards appear on your credit report in the last 24 months–regardless of your credit score. If someone has added you as an authorized user on their card, that…

-

Chase Freedom Ultimate Rewards vs Sapphire Preferred Ultimate Rewards: Know Your Points!

When it comes to getting the most out of your Ultimate Rewards points, it’s essential to know which points you have, so that you can determine if you’re redeeming them for the highest possible value. I’ll explain the differences to make sure you’re not leaving money on the table. Chase has two flagship credit cards: Freedom and Sapphire Preferred. Every dollar you charge to these two cards earns you points in the Ultimate Rewards program. While each card shares the “Ultimate Rewards” name, there are important differences in how you can redeem your points. Chase Freedom Ultimate Rewards There 6 ways you can use the Ultimate Rewards (UR) points that…

-

Chase Freedom: A Cashback Card with a Twist

Still can’t decide between cashback or rewards credit cards? The Chase Freedom is a great card for those just starting out. This card gives you the “freedom” to make your cashback/rewards choice at a later date. And, right now is a great time to apply for the card. The sign-up bonus has been temporarily increased to $150 (normally $100) and between now and December 31, 2015, you’ll earn 10% instead of 5% cash back at Amazon, Zappos, Audible, and Diapers.com. Ultimate Rewards While Chase calls Freedom a cash back card, it actually earns Ultimate Rewards (UR) points that you can later exchange for cash. There’s actually two types of UR…

RECENT POSTS