-

Primer on Chase Sapphire Reserve $300 Travel Credit

Update: Due to the lack of travel during the COVID-19 pandemic, Chase has extended the ability to apply the travel credit to purchases at grocery stores and gas stations through June 30, 2021. The annual $300 Travel Credit is easily the most lucrative benefit of the Chase Sapphire Reserve card. Questions about what it covers and when it resets have been plentiful. It’s important to understand the benefit to know if and/or when you should apply. Fully monetizing the credit each year will effectively reduce the annual fee of the Sapphire Reserve from $550 to a net $250. You can receive this benefit twice in the first year of holding…

-

American Express Launches Four New Hilton Credit Cards

American Express has launched four new Hilton credit cards featuring enhanced benefits and even more perks. American Express has become the exclusive issuer of Hilton credit cards, with existing Citi Hilton cards being moved over to Amex on January 30. The four cards are: Hilton Honors American Express Card which replaces the old no-annual-fee Honors card Hilton Honors American Express Ascend Card which replaces Amex’s old Hilton Surpass card Hilton Honors American Express Business Card Hilton Honors American Express Aspire Card The most interesting is the premium Aspire Card, which comes with Hilton Diamond status and up to $500 in annual travel credits for a $450 annual fee. Details of Each…

-

Booking a Disney World Vacation With Points: My Experience

A family vacation to Disney World in Orlando FL can be very expensive. I can certainly vouch for that as I have a trip planned for this upcoming Spring. In this post, I’ll show you how I reduced my out-of-pocket cost by over 90% using points and benefits I’ve earned from having various credit cards. There’s a lot to cover in this post, so forgive the length. I have a family of 5 spread out over 2 home airports, we’re starting at one hotel then moving to another, and we’ll be visiting the Disney Parks as well as a side-trip to Universal Studios. That’s a lot of moving parts, so…

-

Marriott’s Relationship With Amex and Chase Takes Shape

In the ongoing saga of the recent Marriott and Starwood merger, there has been much speculation regarding the combination of the loyalty programs. Additionally, there was the yet unanswered question. Which bank would win their co-brand credit card battle–American Express or Chase? In the past week, some of those questions have been answered. Since the merger, Marriott has been working to combine the resulting three loyalty programs–Marriott Rewards, Ritz Carlton Rewards, and Starwood Preferred Guest–into one. The first step was to link all three programs. This was done so points could be freely transferred and elite status would be matched. Those initial steps were taken last year. Recent Updates Last week,…

-

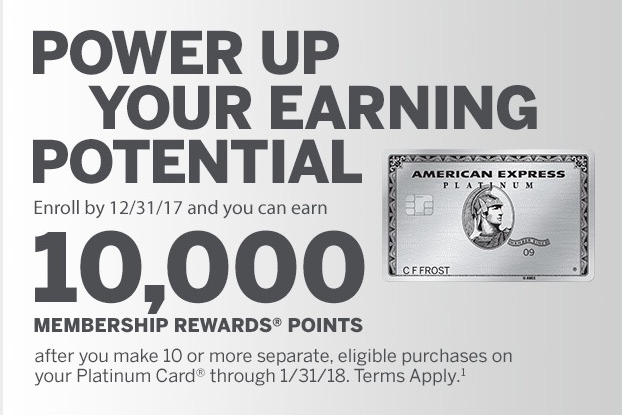

Targeted Offer: 10k Amex Membership Rewards Points for Platinum Card Members

If you are a Platinum Card Member, check your inbox for an email from American Express. You might be able to earn 10,000 bonus Membership Rewards points after your next 10 purchases. This promotion is highly targeted and only open to invited Card Members. The Terms and Conditions state that you can enroll by 12/31/17 and earn 10,000 Membership Rewards points after you make 10 or more separate purchases on your Platinum Card starting from the date you complete enrollment until 1/31/18. Points will be credited to your account 8-12 weeks after you make your 10th purchase. Eligible purchases can be made by the Basic Card Member and any Additional Card…

-

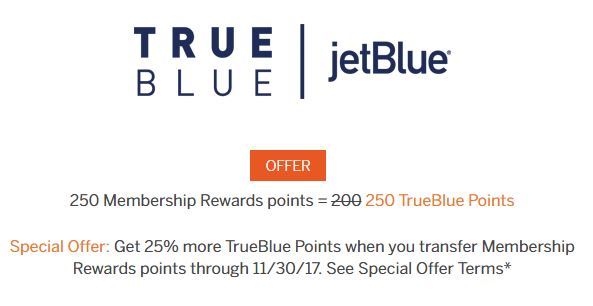

Amex Membership Rewards to JetBlue Bonus

From now through November 30, 2017, American Express card members get 25% Bonus JetBlue TrueBlue points when they transfer Membership Rewards points. The transfer ratio is now an even 250 MR points to 250 TrueBlue points. The normal ratio is 250:200. Depending on the flight, each TrueBlue point can be worth around 1.7-1.8 cents and the points never expire. These transfer bonuses come around occasionally, but certainly not frequently. For regular JetBlue flyers, this can be a good transfer even if you don’t have an immediate need for the points. I took advantage of a similar offer back in May. I proactively transferred some excess Membership Rewards points to…

-

Citi Hilton Cards Moving to Amex in January

Back in June, Hilton announced that American Express would become the exclusive issuer for Hilton Honors co-branded credit cards in the United States beginning January 1, 2018. As that date is approaching, the question of what would become of current Citi Hilton Card holders as finally been addressed. American Express has revamped its portfolio of Hilton Honors credit cards. They’ve added two new cards and increased benefits to re-branded versions of their 2 existing cards. Current Citi Hilton cards will be automatically replaced with one of those two re-branded cards on January 30, 2018. The Citi Hilton Honors Card will automatically be replaced with a Hilton Honors American Express Card. If you have…

-

Four New Amex Hilton Credit Cards Including One With Diamond Status

On January 18, 2018, Hilton and American Express will be releasing four new Hilton credit cards featuring enhanced benefits and even more perks. Next year, American Express will become the exclusive issuer of Hilton credit cards, with existing Citi Hilton cards being moved over to Amex. The four new cards are: the no-annual-fee Hilton Honors American Express Card, the Hilton Honors American Express Ascend Card, the Hilton Honors American Express Business Card and the Hilton Honors American Express Aspire Card. The most interesting is the premium Aspire Card, which comes with Hilton Diamond status and up to $500 in annual travel credits for a $450 annual fee. Details of Each Card…

-

Chase Ultimate Rewards Unexpected Error When Combining Points

Chase has a number of credit cards that earn points in the Ultimate Rewards program. While each of those cards shares the “Ultimate Rewards” name, the points may have a different value depending on which card you redeem them from. The good news is that you can combine them all onto the card with the highest redemption value. The bad news is: It doesn’t always work. The Chase credit cards that earn UR points are: Freedom, Freedom Unlimited, Sapphire, Sapphire Preferred, Sapphire Reserve, and business cards such as Ink Cash, Ink Plus, Ink Preferred. In an earlier article, I showed you how and why you would want to combine your points onto…

-

New 50k Bonus Offer for United MileagePlus Club Card

For a limited time, Chase and United are offering a 50,000 mile welcome bonus for the MileagePlus Club card. This premium card has a $450 annual fee (not waived the first year) but comes with a United Club airport lounge membership (normally $550/year). Keep in mind, this card is subject to Chase’s 5/24 approval rule. The public application link can be found here. I’ve seen various welcome offers for this card in the past: $100 bonus after first purchase, waived first year annual fee, and bonus MileagePlus miles. This is simply the latest bonus flavor. If you’re a frequent flyer thinking about a United Club membership and covet MileagePlus miles,…

RECENT POSTS