-

Chase Freedom 1st Quarter 2018 Bonus Categories

The Chase Freedom credit card earns 5% cash back in bonus categories that change each quarter. The categories for the 1st quarter of 2018 have just been announced. Earn 5% cash back on up to $1,500 in combined purchases from January 1 – March 31, 2018 at: Gas Stations Internet/Cable/Phone Services Chase Pay, Android Pay, Apple Pay, Samsung Pay Gas Stations are a welcome bonus category. The Internet/Cable/Phone Services bonus clashes with holders of Chase’s Ink Plus or Ink Cash business credit cards. Those Chase card holders already get 5x Ultimate Rewards points in that category. Chase has recently been offering bonuses for using digital wallets. It looks like this trend will continue…

-

Earn 10x Chase UR at Best Buy When You Use Chase Pay

Check out using Chase Pay in any Best Buy store, and you’ll automatically earn a total of 10 Ultimate Rewards points (or 10% cash back) per $1 spent on up to $400 in purchases. This offer is valid from November 20 through December 24, 2017 when you use your Chase Sapphire Preferred, Sapphire Reserve, Freedom, or Freedom Unlimited card. Use the Chase Pay mobile app to pay at the register in any Best Buy store. To pay at the store, sign in to the Chase Pay app with your chase.com username and password. Tap the “Pay” button and show the cashier your QR code. Fine Print During the promotional period of November 20, 2017…

-

Chase Announces 4th Quarter Bonus Categories for Freedom Card

The Chase Freedom credit card earns 5% cash back in bonus categories that change each quarter. The categories for the 4th quarter of 2017 have just been announced. Earn 5% cash back on up to $1,500 in combined purchases from October 1 – December 31, 2017 at Walmart and Department Stores. The “Walmart” category does not include merchants operating within or on Walmart premises such as merchants that sell fast food, beauty services, and gas stations that are not Walmart branded. Walmart affiliate businesses such as Sam’s Club are excluded and will not earn bonus rewards. Online purchases at walmart.com are included. The Department Store category does not include supercenters, discount stores or…

-

Activate Discover It and Chase Freedom 5% Categories for Q2 Now

Discover It and Chase Freedom are two high-earning cashback credit cards. Every 3 months, there are new bonus cashback categories where you can earn 5% back on purchases. You can activate those bonus categories right now, prior to the start of the new quarter for both cards. Both cards share similarities. Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter. You need to activate the card each quarter to earn the bonuses. And you receive unlimited 1% cash back on all other purchases. Chase Freedom Use My Referral Link to Apply Activation Link This quarter’s Chase Freedom 5% bonus categories are Grocery Stores and Drugstores.…

-

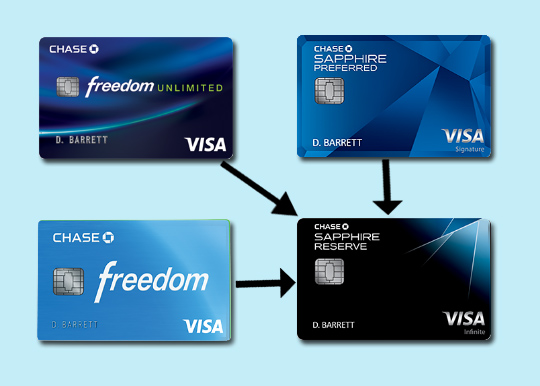

How to Transfer Chase Points to the Sapphire Reserve Card

Chase has a number of credit cards that earn points in the Ultimate Rewards program, and depending on how you redeem them, they could have a different value. I’ll show you how to transfer your points to the card that gives them the highest value–Chase Sapphire Reserve. The Chase credit cards that earn UR points are: Freedom, Freedom Unlimited, Sapphire, Sapphire Preferred, Sapphire Reserve, and business cards such as Ink Cash, Ink Unlimited, Ink Preferred. While each card shares the “Ultimate Rewards” name, there are differences in how you can redeem your points among those cards. The good news is that you can earn points in each card’s generous bonus categories, then…

-

Should You Pay the Annual Fee for the Chase Sapphire Preferred?

Chase Sapphire Preferred (CSP) provides a number of additional benefits that the Chase Freedom card doesn’t offer. However, those extras come at a cost. After being waived the first year, the annual fee of $95 will kick in. Is it worth paying? I’ll walk you through the extra benefits and do the math for you with a calculator at the end of this article. The premise behind this exercise is that you are deciding whether to keep your CSP and pay the annual fee or downgrade it to a Freedom card to save the $95 (or simply cancel if you already have a Freedom). To make this determination, my calculator requires only 4 variables:…

-

Time to Plan Some Late Summer Home Improvement Projects with Discover It Card

The Discover It card’s 5% Cashback Bonus categories for the remainder of 2016 were recently announced, and July through September looks compelling. Use your Discover It card at home improvement stores like Lowe’s and Home Depot in the 3rd Quarter and get 5% cashback on up to $1,500 in purchases. If you’re planning some projects now, it might be worth putting them off until July to capitalize on the bonus–wish me luck explaining that to Mrs. PointsYak. All the 2016 bonus categories are listed in the graphic below. Amazon.com is prominently featured in the entire second half of the year, while “& More” in the 4th Quarter is vague at best.…

-

Get a Credit Card Signup Bonus with your Next Big Purchase

Do you have a fairly large purchase requirement on the horizon? Consider applying for a new credit card that offers a generous signup bonus on which you can charge the purchase to soften the blow. If you have excellent credit and don’t plan on shopping for any loans in the next few months, then this might be exactly the right time! The most lucrative benefit a credit card typically offers is its signup bonus. For many consumers, however, the biggest hurdle to earning the bonus is meeting the minimum spend requirement. But if you’re about to buy some new furniture, jewelry or appliance, or you just NEED to have that 70″ flat screen 4k Ultra HD…

-

How to Transfer Chase Ultimate Rewards to Travel Partners

Do you want to get the best value from your Chase Ultimate Rewards points? As I wrote in Chase Sapphire Preferred 50k Bonus Points – How to Use Them Best, the greatest value can be realized when you transfer them to airline frequent flier and hotel loyalty accounts. This step-by-step guide will walk you through the process. Introduction The Ultimate Rewards travel transfer option that I’ll be explaining is only available if you have a Sapphire Preferred , Sapphire Reserve, or Ink Plus business card. If you only hold a Chase Freedom, Freedom Unlimited or Ink Cash card, you’ll need to add a premium card to your wallet in order to take advantage of…

-

Best Credit Cards for Balance Transfers

Did you run up large credit card balances during the holidays this year? If you won’t have enough cash to pay them off in full, those interest charges are going to start adding up quickly. One way to save money is by transferring your balances to a credit card that has a lower interest rate (APR). Chase Freedom, Citi Double Cash, and American Express Blue Cash Everyday are popular credit cards that offer an introductory 0% APR for 15 months on balance transfers. Unfortunately, they all charge a 3% transfer fee. If you’re looking to consolidate $2,500 to one of these cards, the fee will cost you $75. Chase Slate is a…

RECENT POSTS