-

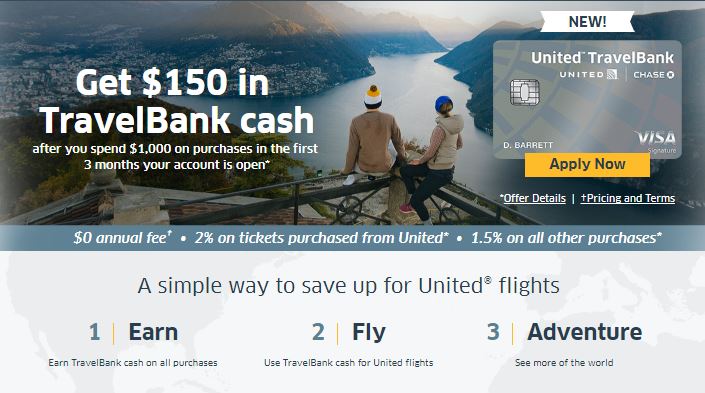

New Chase United TravelBank Credit Card

Chase and United Airlines have launched a new credit card, the Chase United TravelBank Card. Unlike traditional airline credit cards that earn frequent flyer miles, this no-annual-fee card earns United TravelBank cash that can be redeemed toward the purchase of a United ticket. This hybrid cash back/travel rewards card won’t attract savvy points & miles junkies, but it might appeal to the casual United flyer. The Chase United TravelBank card does not offer perks that you see with other premium travel cards such as free checked bags, priority boarding or airport lounge access. The only travel-day benefit is a 25% discount on food and beverage purchases onboard. New cardholders will earn a signup…

-

Amex Launches New Delta No Annual Fee Credit Card

Today, American Express and Delta launched the new Blue Delta SkyMiles credit card. The new card earns miles in the Delta SkyMiles program and carries no annual fee. In addition, you can earn 10,000 Bonus Miles after spending $500 in purchases on your new Card in your first 3 months of Card Membership. The Offer Terms include some new language that I haven’t seen before from American Express. The new language is in bold: Welcome bonus offer not available to applicants who: • Have or have had this product or the Delta SkyMiles® Options Credit Card, or • Currently have or have had one of the following products in the last…

-

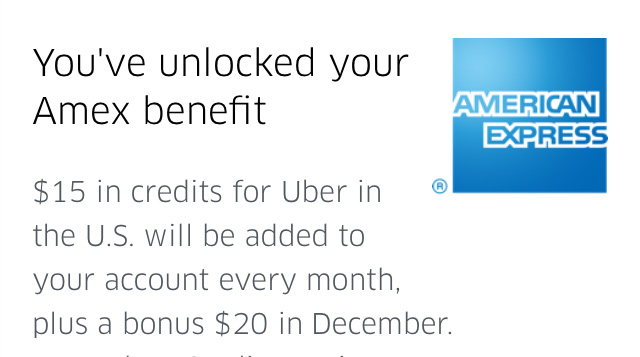

New Amex Platinum Benefits–What You Need to Know.

Last month, American Express announced Changes to its Platinum Card, including uew Uber benefits, 5x Membership Rewards for certain hotel bookings, and a new metal Card design. Along with the new perks, the annual fee was increasing to $550 for new applicants. All these changes are now live. Here’s what you need to know. New Annual Fee For new applicants, the annual fee for the Platinum Card is now $550. For Existing Platinum Card Members, the new annual fee will take effect on their annual renewal date if it is after September 1, 2017. If your annual fee renewal date is prior to September 1, 2017, you will be billed $450, and the new annual…

-

New Premier Dining Rewards card from Capital One

Capital One has added a new credit card to its cash back offerings: the Premier Dining Rewards card. The card earns unlimited cash back rewards on dining, groceries and all other purchases for no annual fee. If you eat out a lot, this card definitely deserves a look. Card Details Earn 3% cash back on dining Earn 2% cash back on groceries Earn 1% cash back on all other purchases $100 signup bonus when you spend $500 in the first 3 months No foreign transaction fees No annual fee Mastercard World Elite benefits Capital One is one of the few banks that offer the no foreign transaction fee benefit with…

-

Comparing Amex Everyday and Everyday Preferred Cards

Whenever I’m asked what the best credit card is, my answer is always, “It depends.” Even making a recommendation between just two cards leads me to respond the same way. Case in point: the Everyday and Everyday Preferred cards from American Express. If you are a fan of Amex’s Membership Rewards program, one of these two cards is a good choice for you. I can’t tell you which is the better choice, but at the end of this post you’ll find a calculator that will help you decide for yourself. Lets take a look at each card’s benefits. Amex Everyday Card 2x Membership Rewards points at U.S. Supermarkets (on up…

-

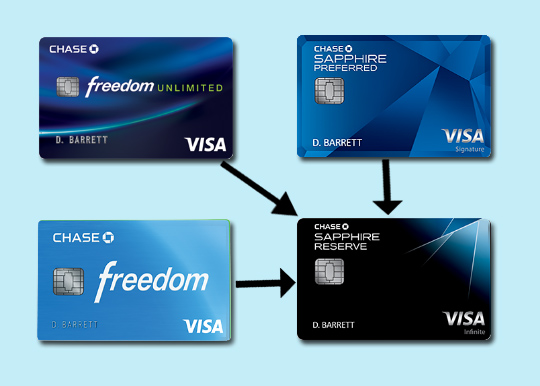

Should You Cancel Sapphire Preferred after getting the Reserve Card?

Congratulations! You’ve been approved for the extremely popular Chase Sapphire Reserve credit card! Now what should you do with the your other Ultimate Rewards earning cards like Freedom and Freedom Unlimited? Should you cancel Sapphire Preferred? The answer is different for each card. There’s no reason to cancel the cards that don’t charge an annual fee, but Sapphire Preferred does and also shares many of the same benefits as Sapphire Reserve. I’ll go through each card and explain what your options are. Background Having additional Chase credit cards that earn Ultimate Rewards is a great complement to the Sapphire Reserve. You can earn points by purchasing goods and services with one card, then…

-

How Does Chase Sapphire Reserve’s Travel Credit Impact the Signup Bonus?

When I applied for the Chase Sapphire Reserve card in January, the signup bonus was 100,000 Ultimate Rewards Points after spending $4,000 in the first 3 months. I’ve been asked what would happen if some of that spending was on travel, triggering the $300 travel credit. If the credit takes you back below $4,000, do you still get the points? I had already received some travel credits as soon as I got the card and was getting close to meeting my own spending requirement. So, I decided to test this for myself. My plan was simple: get to just over $4,000 in total spending and stop using the card. Other…

-

How to Transfer Chase Points to the Sapphire Reserve Card

Chase has a number of credit cards that earn points in the Ultimate Rewards program, and depending on how you redeem them, they could have a different value. I’ll show you how to transfer your points to the card that gives them the highest value–Chase Sapphire Reserve. The Chase credit cards that earn UR points are: Freedom, Freedom Unlimited, Sapphire, Sapphire Preferred, Sapphire Reserve, and business cards such as Ink Cash, Ink Unlimited, Ink Preferred. While each card shares the “Ultimate Rewards” name, there are differences in how you can redeem your points among those cards. The good news is that you can earn points in each card’s generous bonus categories, then…

-

10% Cash back at Restaurants with Amex Blue Cash

American Express has announced a unique promotion for new customers applying for their Blue Cash Everyday and Blue Cash Preferred Cards. New Card Members will earn 10% cash back at restaurants in the first six months, up to $200. New Card Members will also receive the regular welcome bonus of $100 for the Everyday or $150 for the Preferred. These cashback bonuses come in the form of a statement credit after spending $1000 in the first 3 months after approval. If you are a targeted customer (or if you use your browser’s “incognito” window), the welcome bonus may be as high as $250 for either card. To decide which card is…

-

Limited Time Offer: 35k Point Signup Bonus for Amex SPG Cards

American Express is offering a limited time increased signup bonus for its Starwood Preferred Guest Personal and Business credit cards. The signup bonuses are normally 25,000 Starpoints. This limited time offer ends April 5, 2017. The Personal and Business card offers are a bit different. With the Personal card, you earn 25,000 bonus Starpoints after you use your new Card to make $3,000 in purchases within the first 3 months and an extra 10,000 bonus Starpoints after you make an additional $2,000 in purchases within the first 6 months. With the Business card, you earn 25,000 bonus Starpoints after $5,000 in purchases within the first 3 months and an extra 10,000…

RECENT POSTS