Why is the Chase 5/24 Rule So Confusing?

I had a recent exchange with someone claiming to have been approved for Chase Freedom Unlimited despite being at 5/24. As it turns out, he was only 4/24, and that’s why he wasn’t declined.

That begs the question: “How could it be so hard to count to 5?” Well, Chase’s 5/24 rule is not so straightforward. In fact, it’s downright confusing. It can make a reasonably intelligent person have trouble counting to 5.

In this post, I will try to clear up some of the most confusing concepts of the 5/24 rule, including the reason that the Freedom Unlimited application I mentioned above was approved.

What is the Chase 5/24 Rule?

If you want a full understanding of the Chase 5/24 rule, you can refer to my comprehensive post on the subject. This post only intends to clear up some of the confusion. For now, here’s a pull quote of my definition:

If your credit report lists 5 or more credit card accounts from any bank that were opened in the last 24 months, Chase will–in almost all circumstances–automatically deny your application for their credit cards, regardless of any other factors.

That’s a bit wordy for one sentence, but makes the point.

What’s So Confusing?

It seems pretty straightforward, but mainly because of exceptions and timing, it can get complicated. Lets start with the person I mentioned in the first paragraph. They really had been approved for 5 credit cards in the last 24 months PRIOR to applying for Freedom Unlimited. So, why were they approved despite being 5/24? The answer is due to timing.

Count to 5 with Chase’s Eyes–Not Yours

Chase can only count what they see. Credit cards that you just opened recently, may not YET appear on your credit report. For instance, American Express credit cards take two billing cycles to appear on your report. The reader mentioned above was approved for an Amex card only 2 weeks prior. He thought that brought him to 5/24, but since that card is not yet on his credit report, he was really only 4/24.

Most small business credit cards don’t count, including Chase’s own business cards. Since these are not reported to the Credit Reporting Agencies and don’t appear on your credit reports, they don’t add to your 5/24 count.

If Business Cards Don’t Count, Why Was I Denied for a Chase Business Card Due to 5/24?

This is another common misconception about the rule. Business cards don’t count in that they don’t increase your 5/24 count. That much is true. However, to be approved for a Chase Business credit card, you must be under 5/24. In other words, Chase Business cards don’t count, but they are subject to 5/24.

Not All Credit Cards Increase Your 5/24 Count

Now we’re really adding to the confusion. If you’ve opened a credit card at certain retail stores, it might not add to your 5/24 count.

Take a look at how the account is listed on your credit report. Cards that can be used only in that one store are typically denoted as a “Charge Account.” These cards are typically ignored by the Chase 5/24 algorithm.

If your store card has a Visa, MasterCard, or Amex brand on it, the card can be used anywhere and will add to your 5/24 count.

But I Only Opened 4, not 5, Chase Cards in the Last 24 Months

This is a common complaint I come across after Chase denials. Although this is a rule enforced by Chase for their cards, they count all your recently opened credit cards from other banks too.

Closed Cards Count Too

You forgot that you opened a credit card 18 months ago, but closed it after 1 year? It counts. It doesn’t matter if the account is still active or not, only whether or not the it was originally opened less than 24 months ago.

What About Loans?

Mortgages, student loans, auto loans and leases don’t add to your 5/24 count.

I’m an Authorized User on Someone Else’s Account. Does That Count?

You’ll love this answer. Yes… and No. Chase’s computer algorithm will count these cards if they appear on your credit report. If they put you over 5/24, whatever Chase card you’re applying to will be denied.

The good news is that if you call Chase’s reconsideration department after being denied for “too many cards in the last 24 months”, you can get a credit analyst to ignore the authorized user cards and manually review your application. Here’s how:

- Ask the analyst to list all of your credit cards, one at a time

- When they mention the Authorized User card, say these magic words: “I am not financially responsible for this account.”

This won’t guarantee approval, but it will get past the 5/24 denial.

Pre-Approvals Circumvent 5/24

OK, you’ve read through this entire post and are no longer confused. You are, without a doubt, OVER 5/24. All hope is not lost. Pre-approvals will set you free!

Note that pre-approvals are specifically defined. Offers you get via email or snail mail are “pre-qualified” offers. Those won’t help. You will find pre-approved offers either in your Chase online account or in a Chase branch. Ask a banker (not a teller) to check.

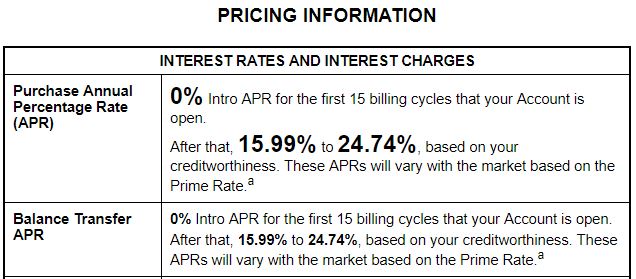

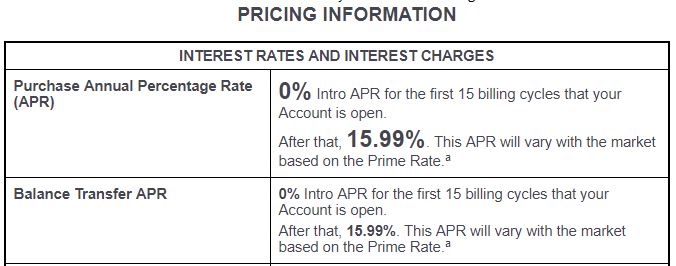

Pre-approvals can be identified by looking at the Interest Rates and Interest Charges section of the Schumer Box. If the Purchase APR is a range, like 15.99% – 24.74%, this is not a pre-approved offering.

If the Purchase APR is fixed, like simply 15.99%, then this is a pre-approved offering and should circumvent the 5/24 rule.

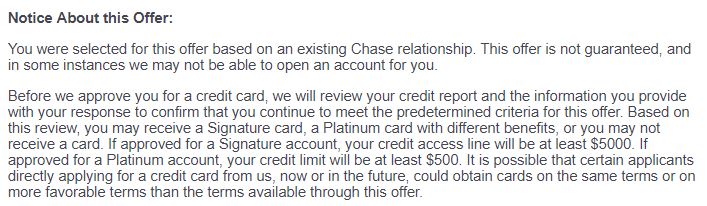

Another sure sign of a pre-approved offer is language in the terms about you being selected for the offer based on your relationship with Chase.

Business Relationship Managers Can Get You an Ink Business Card

Chase employs Business Relationship Managers (BRMs) that can get around 5/24 for Ink applications. BRMs don’t work at any specific branch, they travel between branches to take meetings with larger business clients.

If you find one willing to meet with you, they can apply on your behalf via a DocuSign process (paper application) that circumvents the 5/24 algorithm.

Summary

I hope after all this, you can see why the Chase 5/24 rule can be confusing. Since it’s an unwritten rule, all this information has been cobbled together using crowd-sourced data points. Separating the misinformation from real information only adds to the confusion.