-

This Credit Card Will Pay You $120/yr With Little Spend

Cash back credit cards generally base their rewards on how much you use the card. The more you spend, the more you earn. The BankAmericard Better Balance Rewards card is different–it rewards you for responsibly managing your credit card balance. With this card, you can earn up to $30 per quarter when you pay more than your monthly minimum on time each month. There’s no minimum spend requirement, but you need to have a statement balance each month. Lets look at the card basics before going through the process. Card Details Earn $25 per quarter when you pay more than the monthly minimum on time each month–that can be up to…

-

What’s the Best Cash Back Credit Card if You Only Want One Card?

If you like cash back credit cards and prefer simplicity, consider the Double Cash card offered by Citi. There are no category bonuses or quarterly activations to keep track of, just 2% back on all your spending. I generally don’t advocate having only one credit card as I feel that multiple cards are the best way to maximize bonuses. That being said, there are those prefer a single go-to card for all purchases. For them, I always recommend Citi Double Cash. This card has merit even if you have multiple cash back credit cards (one for groceries, one for gas, etc.), there is always that “everything else” category that no…

-

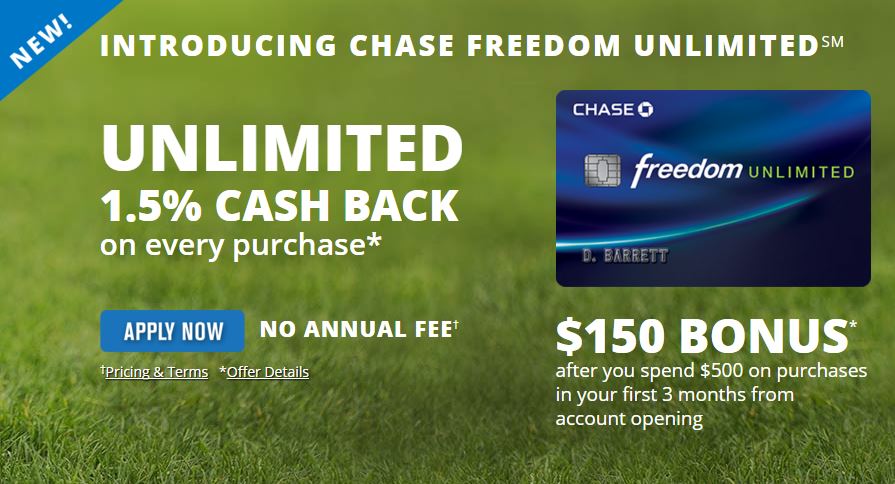

New Freedom Unlimited Credit Card from Chase

Chase has added another credit card to its Ultimate Rewards arsenal. The new Freedom Unlimited, unlike its sibling, has no category bonuses or quarterly activations. You earn 1.5 points on every dollar you spend–unlimited. Freedom Unlimited is a great complement to Chase’s other Ultimate Rewards earning cards. Continue to use the other cards to spend in bonus categories. Freedom Unlimited is now the card to use for “everything else.” Card Details 15,000 ($150) bonus points after you spend $500 on purchases in your first 3 months 2,500 ($25) bonus points when you add your first authorized user and make your first purchase in your first 3 months 1.5x Ultimate Rewards points on all…

-

Celebrate Leap Day with Free Money from Ebates

I must confess, I’m not a fan of crowded malls, however, I am a big fan of getting a great deal. I can accomplish both by purchasing my items online through shopping portals, a great way to earn extra cashback in addition to rewards earned with your credit card. And today only, Ebates, a popular shopping portal, is offering double cashback at over 500 stores to celebrate leap day. What is a shopping portal? In short, a shopping portal is a website that provide links to various internet retailers. In return for directing customers to their site, those retailers pay a commission to the portal for each customer that makes a qualifying purchase. The…

-

Time to Plan Some Late Summer Home Improvement Projects with Discover It Card

The Discover It card’s 5% Cashback Bonus categories for the remainder of 2016 were recently announced, and July through September looks compelling. Use your Discover It card at home improvement stores like Lowe’s and Home Depot in the 3rd Quarter and get 5% cashback on up to $1,500 in purchases. If you’re planning some projects now, it might be worth putting them off until July to capitalize on the bonus–wish me luck explaining that to Mrs. PointsYak. All the 2016 bonus categories are listed in the graphic below. Amazon.com is prominently featured in the entire second half of the year, while “& More” in the 4th Quarter is vague at best.…

-

My Latest Credit Card Retention Call

It’s been a year since I was approved for my Chase United MileagePlus Explorer credit card. At the time, my account was targeted for 50,000 MileagePlus Miles after spending $3,000 in addition to the usual no annual fee for the first year. I was able to take advantage of that offer AND get a $50 statement credit for applying while booking a flight on United’s website. I never did complete the flight booking, I just wanted the $50 credit! This morning, I noticed that the $95 annual fee charge for the card appeared in my account, so it may be time to cancel. It’s not uncommon for credit card issuers…

-

Before You Cancel That Credit Card, Read This!

One question that I am asked frequently is: “Will it help or hurt my credit score if I cancel a credit card?” I can say with certainty that the singular act of cancelling a card will never help your score. And, depending on your credit profile, the negative impact could range from negligible to significant. In my article “Decoding Credit Score Mystery Math“, I explained the factors that make up your score. The three largest factors are: Payment History (35%), Credit Utilization (30%), and Average Age of Accounts (15%). Let’s have a look at how canceling a credit card impacts these factors. Payment History Some readers may feel that closing a credit card where they have…

-

A Handy Tool For Using the Right Credit Card for Every Purchase

You’re standing in line at the grocery or office supply store, holding a wallet overflowing with credit cards, and you can’t remember which one you should use to get the most cash back. Sound familiar? Same here, and that’s exactly why I created the PointsYak Cashback Lookup Tool: just follow the link, bookmark it on your mobile phone, and finding the right cashback card for every purchase will always be just a click away! There’s no app to download, no GPS tracking your whereabouts, and no sign-up required. Shopping online is usually the best the way to maximize your savings, and my last article, “Maximize Cashback and Points Using Online Shopping Portals”, showed you how…

-

Maximize Cashback and Points Using Online Shopping Portals

I must confess, I’m not a fan of crowded malls, however, I am a big fan of getting a great deal. I can accomplish both by purchasing my items online through shopping portals, a great way to earn extra miles, points or cashback in addition to rewards earned with your credit card. What is a shopping portal? In short, shopping portals are websites that provide links to various internet retailers. In return for directing customers to their site, those retailers pay a commission to the portal for each customer that makes a qualifying purchase. The portal then allots a portion of that commission–in the form of points or cash–to the original customer. You get paid…

-

How to Transfer Chase Ultimate Rewards to Travel Partners

Do you want to get the best value from your Chase Ultimate Rewards points? As I wrote in Chase Sapphire Preferred 50k Bonus Points – How to Use Them Best, the greatest value can be realized when you transfer them to airline frequent flier and hotel loyalty accounts. This step-by-step guide will walk you through the process. Introduction The Ultimate Rewards travel transfer option that I’ll be explaining is only available if you have a Sapphire Preferred , Sapphire Reserve, or Ink Plus business card. If you only hold a Chase Freedom, Freedom Unlimited or Ink Cash card, you’ll need to add a premium card to your wallet in order to take advantage of…

RECENT POSTS