Credit Card Annual Fees: Are They Worth It?

There are those who would never apply for a credit card that charges an annual fee. Why pay when there are so many other cards that don’t charge one? A valid question, and the answer depends on your spending and lifestyle habits. As you’ll see below, in some cases, those fees could be well worth paying.

There are those who would never apply for a credit card that charges an annual fee. Why pay when there are so many other cards that don’t charge one? A valid question, and the answer depends on your spending and lifestyle habits. As you’ll see below, in some cases, those fees could be well worth paying.

Annual fees can top out at over $400 for some premium credit cards, but they can include access to airport lounges such as American Airlines, Delta, or United. These private lounges offer travelers free food, snacks, complimentary beverage service, comfortable seating, free WiFi, clean facilities, and other luxurious perks not available to the general public. If you fly frequently enough, this benefit could be invaluable.

And what about cash back cards? Does it make sense to pay a fee to get your own cash back? If the value of the benefits received exceeds the annual fee paid–Absolutely! For these cards, a quick look at your own spending habits and a little bit of math is all you need to figure out if the fee is worth it in your case.

Lets compare 2 popular cash back credit cards–one that charges an annual fee and one that doesn’t–offered by American Express: Blue Cash Everyday and Blue Cash Preferred. Here are the basics:

Blue Cash Everyday

- 3% Cash Back at U.S. supermarkets, up to $6,000 per year in purchases (then 1%)

- 2% cash back at U.S. gas stations

- 2% Cash Back at select U.S. department stores

- 1% Cash Back on other purchases.

- No Annual Fee

- $100 sign-up bonus after $1000 spend in first 3 months

Blue Cash Preferred

- 6% Cash Back at U.S. supermarkets up to $6,000 per year in purchases (then 1%)

- 3% Cash Back at U.S. gas stations

- 3% Cash Back at select U.S. department stores

- 1% Cash Back on other purchases

- $75 Annual Fee

- $150 sign-up bonus after $1000 spend in first 3 months

As you can see, increased benefits come with the annual fee, but is it worth it for you? According to this report by the Bureau of Labor Statistics, in 2014 the average US household spent:

- $3,971 for food at home

- $2,468 on gasoline and motor oil

- $1,786 on apparel and services

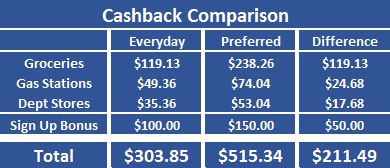

Using those average spending statistics and the individual benefits of each card, we can compute how much cashback would be earned in each of those spending categories during the first year of holding either card.

Including the sign up bonus, the average US household would earn $211.49 in additional cash back by using the Blue Cash Preferred vs. the exact same spending on the Blue Cash Everyday. Would you pay $75 cash for $211 cash? I know I would!