Chase Freedom Ultimate Rewards vs Sapphire Preferred Ultimate Rewards: Know Your Points!

When it comes to getting the most out of your Ultimate Rewards points, it’s essential to know which points you have, so that you can determine if you’re redeeming them for the highest possible value. I’ll explain the differences to make sure you’re not leaving money on the table.

When it comes to getting the most out of your Ultimate Rewards points, it’s essential to know which points you have, so that you can determine if you’re redeeming them for the highest possible value. I’ll explain the differences to make sure you’re not leaving money on the table.

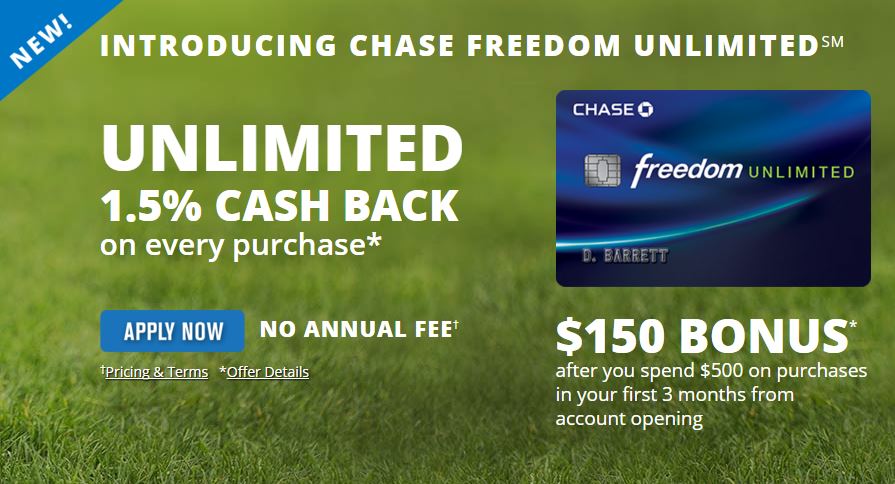

Chase has two flagship credit cards: Freedom and Sapphire Preferred. Every dollar you charge to these two cards earns you points in the Ultimate Rewards program. While each card shares the “Ultimate Rewards” name, there are important differences in how you can redeem your points.

Chase Freedom Ultimate Rewards

There 6 ways you can use the Ultimate Rewards (UR) points that you have earned with your Chase Freedom credit card. The first 5 redemption methods always result in a value of 1 cent per point. Method 6 is where you can achieve even more value for your hard-earned points.

1. Redeem for cash

This option allows you to have a cash amount deposited directly into your bank account. Alternatively, you can exchange points for cash to use as a statement credit on your Chase bill. Simply select the number of points you wish to redeem, choose where you want the credit, and voila! Cash back to you! The minimum number of points required for this method is 2,000 ($20.00).

2. Redeem for gift cards

There are gift cards available from various retailers that you can purchase using your points via the Ultimate Rewards website. Gift cards start as low as 500 points (worth $5 at Starbucks).

3. Redeem on Amazon.com

Freedom cardholders earn bonus points for spending at Amazon.com (referral link) during October, November, and December. Chase and Amazon make it easy for you to redeem those points right back at the same retailer: Simply link your Amazon account to your UR account and apply as many points as you like to your checkout cost.

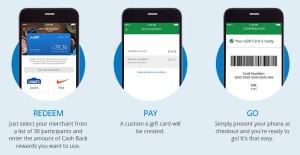

4. Redeem at the register

4. Redeem at the register

There are 30 retailers where you can use the Chase mobile app to redeem your points for an instant e-gift card, which you can then use during checkout right at the in-store register. To me, this seems like a lot of unnecessary extra effort. I’d rather charge the purchase to my Freedom card, earn even more points, and pay that portion of my statement with points later on.

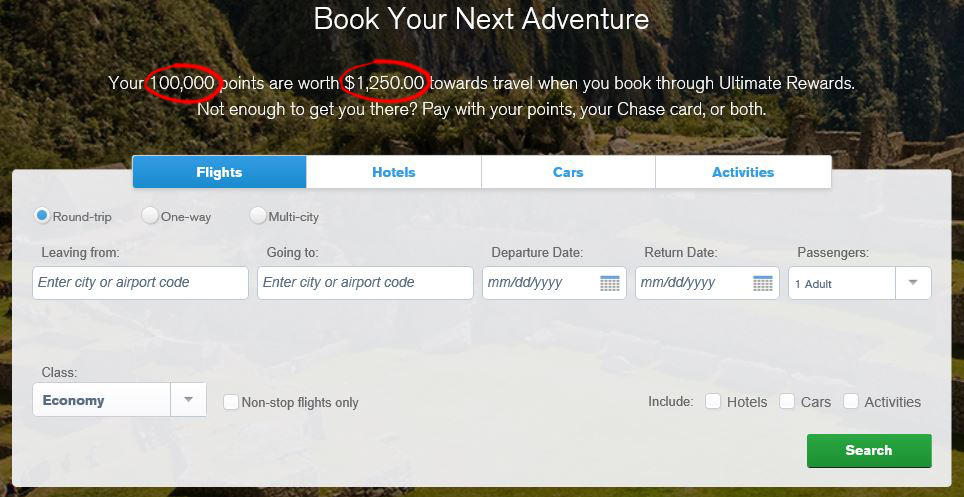

5. Redeem for travel

The UR website has a travel booking engine similar to other online travel booking sites. You can choose to pay for all or any portion of the cost with your points. Like redeeming at the register, I wouldn’t recommend using this method for redeeming. Instead, you can earn additional points by charging this travel purchase to your card and redeeming for statement credit later. In addition, you might potentially be paying a higher price by not shopping around at other online travel booking sites.

6. Transfer to Sapphire Preferred Ultimate Rewards

If you or one of the authorized users of your Freedom card also have a Chase Sapphire Preferred card, you can transfer any or all your points to that card for more valuable benefits. This is the one-two punch I referred to in my post Chase Freedom: A Cashback Card with a Twist.

Chase Sapphire Preferred Ultimate Rewards

Just like with Freedom UR points, you can redeem Sapphire Preferred UR points for cash, for gift cards, or on Amazon.com at the same value of 1 cent per point. Redeeming at the register is an exclusive feature of the Freedom card. I doubt Sapphire Preferred cardholders would miss it.

When you pay for travel using your Sapphire card’s UR points, those points are worth 1.25 cents per point as opposed to just 1 cent with Freedom’s points. That’s 25% more travel value just for redeeming with the right card.

The greatest value can be realized when you transfer Ultimate Rewards points to frequent flier and hotel loyalty accounts. At present, you can transfer points at a 1:1 ratio to the following frequent flier programs:

- Air France/KLM Flying Blue

- British Airways Executive Club

- Korean Air SKYPASS

- Singapore Airlines KrisFlyer

- Southwast Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

In addition, you can transfer points at the same 1:1 ratio to the following hotel loyalty accounts:

- Hyatt Gold Passport

- IHG Rewards Club

- Marriott Rewards

- The Ritz-Carlton Rewards

Until December 7, 2015, you can also transfer points to Amtrak Guest Rewards. After that date, Amtrak will no longer be partnering with Chase and will cease to be a transfer option.

The value that you can achieve via this method is completely dependent on each program’s reward point requirements and availability, though upwards of 1.5 cents per UR point can be easily reached. For first/business class flights and premium hotels, an even greater value can be extracted. It’s important to understand each partner program and check availability before transferring points from UR as transfers cannot be reversed.

The increased flexibility to transfer to travel partners does come at a cost. The Chase Sapphire Preferred carries a $95 annual fee, which is waived the first year. For a limited time, Chase is offering a higher sign-up bonus of 50,000 (normally 40,000) UR points after spending $4,000 in the first 3 months. Those points are worth a minimum of $625 if spent on travel.

Knowing the best method to redeem points is equally as important as knowing how to earn them. Make sure you do your math to extract the greatest value. How have you redeemed your points? Share your points redemption success stories in the comments below.